Access to Insurance Initiative Newsletter 9/2017

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Visit us at www.a2ii.org.

Recent Events

Inclusive Insurance Training Programme for Supervisors in Sub-Saharan Africa

4-8 September 2017, Dar es Salaam, Tanzania

This training programme exposed insurance supervisors to how sound supervisory principles can be applied in a manner that encourages the development of an inclusive insurance market. The participants learned about the role of the supervisor and prudential and market conduct issues in overseeing inclusive insurance markets.

The training was based on the IAIS Application paper on the regulation and supervision of inclusive insurance markets and IAIS-A2ii Core Curriculum for Insurance Supervisors: Regulation and Supervision Supporting Inclusive Insurance Markets.

Throughout the interactive sessions, the participants shared their experiences in group discussions and activities. Practical examples to supervising inclusive insurance included:

-

Case studies and presentations from Ghana and Tanzania on their experiences in developing a supervisory approach to support inclusive insurance;

-

Supervisory approaches to mobile insurance in Ghana;

-

Index-based agricultural insurance in Kenya.

The participants worked on action plans to tackle specific challenges in supporting inclusive insurance markets in their home countries. These action plans are aimed to ensure that participants put lessons learned during the training into practice upon return home to their supervisory authorities.

34 representatives from insurance supervisors from 11 countries across Sub-Saharan Africa attended the programme hosted by the Tanzanian Insurance Regulatory Authority (TIRA), and jointly organised by the Toronto Centre and the Access to Insurance Initiative (A2ii) and supported by the International Association of Insurance Supervisors (IAIS).

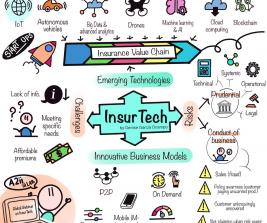

24th A2ii-IAIS Consultation Call on 'Supervising InsurTech'

21 September 2017

On this call, emerging technologies and how they affect the insurance market, consumers and supervisors were discussed. Stefan Claus, Bank of England, Didier Warzee, ACPR and Denise Garcia, CNSF, Mexico on the English, French and Spanish call, respectively, presented the results of an IAIS stocktaking study on FinTech Developments in the Insurance Industry concluded earlier in the year.

Emerging technological innovations in the insurance value chain are confronting supervisors with new questions. Consumers’ needs have evolved, distribution channels have digitalised, the Internet of Things is affecting how risk is underwritten and predicted, and Peer-to-Peer technology is set to affect claims management.

All these aspects hold great promise for extending access to insurance for those previously underserved by more traditional business models. However, extending the reach of insurance coverage more widely and the complexity of some of the business models used also presents a number of risks which must be addressed.

On the calls, additional country case studies were provided by UK Financial Conduct Authority and BaFin (German supervisory authority). Fifty-eight insurance supervisors from 25 countries participated.

For the presentations in English, French or Spanish click here.

A report summarising the discussions from all 4 calls will be published later in the year.

A2ii hosts a regulatory panel discussion on Micro, Small and Medium Enterpreises

21-22 September 2017, Ulaanbaatar, Mongolia

On 21 September, the A2ii hosted a panel discussion at the two-day Asia Learning Session and Public Private Dialogue (PPD3) for Asian regulators on the topic of Inclusive Insurance for MSMEs (Micro, Small and Medium Enterprises) in Ulaanbaatar, Mongolia. The A2ii panel at this event focused on regulatory aspects that can enable insurance for micro and small enterprises, and was an exchange between participants from Indonesia, the Philippines, and the SECP of Pakistan. 123 attendees were present.

The session focused on ways in which proportionate approaches to regulation can help stimulate insurers to offer products for small businesses, and what kind of framework conditions regulators can set up to unlock the potential of a well-insured entrepreneurial sector. Panellists noted how important it is to have strong inter-institutional cooperation, led from a high level of government, which can align all stakeholders behind a single vision of inclusion. A close, enabling relationship between regulator and industry is also a key to exploring the potential of this market.

The PPD3 meeting was co-organised by the Mutual Exchange Forum on Inclusive Insurance (MEFIN), GIZ RFPI, GIZ Mongolia, and the Financial Regulatory Commission of Mongolia.

Find out more about the event and access Oscar Verlinden's (@Oscar_A2ii) presentation at the panel by clicking here.

IAIS Implementation Committee Meeting

27 September 2017

On September 27th the A2ii participated in the IAIS implementation committee conference call. The committee discussed its draft roadmap for 2018-2019 and an updated draft of the strategic review of the IAIS’s Coordinated Implementation Framework. The Coordination Framework outlines the IAIS’s strategic approach to implementation and was last published in 2013.

This update does not replace the original version, which endorses a regional approach to implementation and working through partners, but supplements it.

Recent Publications

IAIS Application Paper on the Regulation and Supervision of Mutuals, Cooperatives and Community-Based Organisations (MCCOs)

20 September 2017

This paper, published on September 20th, provides guidance to supervisors on how the ICPs can be implemented in a proportionate manner to support the involvement of MCCOs in providing inclusive insurance. The Access to Insurance Initiative (A2ii), as the IAIS´s implementation partner on financial inclusion, was a member of the drafting group.

The paper highlights the dual role that MCCOs can play in an insurance market both as an underwriter of the risk as well as providing administrative, educational and distribution services. The A2iis on the ground experiences working with supervisors as well as a supervisor only WebEx call organised by the A2ii on the topic as part of its Consultation Call series were key inputs to the drafting process.

To access the Paper click here.

Announcements

Staffing Update

We are very happy to welcome Mohammed Rieaz Khan as Junior Advisor and Dunja Latinovic as Communications Advisor to our team.

Dunja brings to the A2ii years of experience in communications, film production and media development. She hopes to strengthen the A2ii with innovative communications practices that drive engagement, interaction and dialogue.

Mohammed is on secondment from the Central bank of Fiji for a period of 12 months. As an experienced supervisor with years of supervision experience in the insurance sector, Mohammed hopes to strengthen the A2ii’s knowledge base, as well as build capacity for the Asian region.