A2ii Newsletter 11/19

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org for news and updates on #inclusiveinsurance.

Featured: Inclusive Insurance Developments Worldwide

Kenya defined microinsurance and index-based insurance in its primary legislation on insurance services

Effective July 2019, Kenya has included in its insurance regulatory law definitions for microinsurance and index-based insurance.

At the core of the definition of microinsurance is increasing insurance accessibility by the low-income population and the underserved markets. It extends to delineate that micro-insurance will be managed per generally accepted insurance principles, i.e. funded by premiums. Read more...

SUGESE Costa Rica new legal opinion on index insurance

At the IAIS – ASSAL Regional Seminar for Insurance Supervisors in Latin America that took place on 15 and 16 October, Tomás Soley Pérez, superintendent of the Superintendencia General de Seguros (SUGESE) spoke of the emerging risks, financial inclusion, access to insurance as the main concerns of the supervisors in the Latin American region and in the context of achieving the SDGs. Costa Rica is located in one of the areas most vulnerable to climate change. Droughts (2008), floods (Huriccane Otto, 2016) and storms (Nate, 2017) affect the country with great intensity and frequency.

Soley Pérez drew attention to the SUGESE’s recent Legal Opinion on index insurance in Costa Rica which is intended to create space for insurers to design and offer such insurance and ultimately, generate greater penetration in coverage against natural disaster risks.

“…In particular, in other countries, this type of insurance is a powerful instrument to extend coverage and access to insurance for small businesses, families and vulnerable economic activities such as agriculture. The development of this new type of insurance will undoubtedly require an accent especially in the clarity of coverage, transparency and fair treatment of the consumer.”, said Tomás Soley Pérez.

The Legal Opinion can be found under this link.

Recent Events

Argentina, India, Morocco and Rwanda to participate in the second Inclusive Insurance Innovation Lab

The selection process for countries to participate in the second Inclusive Insurance Innovation Lab has come to an end. Following a set of pre-defined selection criteria such as supervisors’ demonstrated openness to innovation and the country’s potential to act as a catalyst in the region, four countries were selected: Argentina, India, Morocco and Rwanda. The insurance supervisors of the four selected countries are now being supported in putting together their country teams. These teams will consist of representatives from approximately eight institutions, including the insurance supervisors as well as the main supply- and demand-side stakeholders in the participating countries.

The Inclusive Insurance Innovation Lab is scheduled to begin in early 2020 and last for a period of 18 months. Guided by experienced change facilitators, the four country teams will initially explore the barriers to more inclusive insurance markets in their countries. In a second step, the teams will develop innovative solutions that can help develop their insurance markets.

For more information on the Inclusive Insurance Innovation Lab, please click here or contact mariella.regh@a2ii.org.

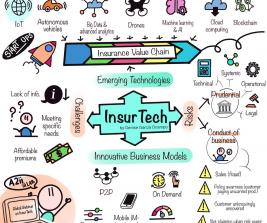

Africa 3.0 InsurTech in Africa

3 October London

The A2ii spoke on a panel discussing ‘how to do business in Africa’. This event was organised by the UK Department for International Trade and aimed at facilitating and encouraging InsurTech start-ups to do business in Africa. The A2ii spoke about how supervisors were increasingly taking ownership for driving market development in their country. Panellists agreed that supervisors being open to dialogue with the industry is vital to encourage responsible innovation, however, regulatory sandboxes were just one among many ways to achieve this and often, depending on the country context, not the most appropriate tool for supervisors to use.

The event also saw a number of pitches from InsurTech’s showcasing some innovative business models. The event was held alongside a bigger ‘InsurTech for Development’ event organised by MarketMinds.

IAIS – ASSAL Regional Seminar for Insurance Supervisors in Latin America

15 – 16 October, San José, Costa Rica

The A2ii Regional Coordinator for Latin America presented before some 110 representatives of insurance supervisory authorities, regional industry and financial sector experts from 13 countries on the topic of Climate and Catastrophic Risks and Agricultural Insurance. The event was jointly organised by the IAIS and the Latin American Association of Insurance Supervisors (ASSAL), and was hosted by the Superintendencia General de Seguros (SUGESE).

IAIS FinTech Forum and FSB-IAIS InsurTech Workshop

21-22 October, London

The A2ii participated in the IAIS FinTech Forum in-person meeting in London on 21st and also the FSB-IAIS InsurTech workshop organised alongside. Given the mainly developed country membership of the group, the A2ii used its participation to ensure that the perspective and needs of developing market supervisors were also represented in the discussions on InsurTech developments.

Conference on Building Financial Inclusion for Microinsurance – Driver of Growth

31 October, Taipei, Chinese Taipei

The A2ii presented on ‘the latest developments in financial inclusion’ at this event organised by the Taiwanese Insurance Institute and supported by the Taiwanese Financial Services Commission. Following the A2iis global overview, inclusive insurance experiences across the region were presented by a mix of industry and supervisory representatives coming from Indonesia, Philippines, Thailand, Malaysia and Taiwan.

The event attracted some 130 representatives majority of which were from the Taiwanese insurance industry.

Upcoming events

17th Consultative Forum on Climate and Disaster Risk for insurance supervisory authorities, insurance practitioners and policymakers “Climate and disaster risk: building resilience, bridging the protection gap in Asia”

4 November, Dhaka, Bangladesh

In 2019, our Consultative Forums explore how insurance providers, policymakers, insurance regulators and supervisors can collaborate to reduce the protection gap and help to build resilience in the face of climate risk and natural disasters.

The 17th Consultative Forum will provide a platform for dialogue between these stakeholders, as well as the opportunity to meet with and learn from colleagues and experts involved in climate change from Asia and other regions.Key themes:

- Why does the protection gap exist and why does it matter?

- What barriers do actors from both the private and the public sectors need to overcome to build the resilience of vulnerable households and small businesses to climate change?

- Which innovative approaches have been addressing vulnerability to climate change and building resilience to shocks at scale?

- How can sovereign insurance and microinsurance reinforce and not undermine one another?

The Forum is jointly organised by the International Association of Insurance Supervisors (IAIS), the Access to Insurance Initiative (A2ii), the Microinsurance Network (MiN), and the InsuResilience Global Partnership. It is hosted by the Bangladesh Insurance Association (BIA) and Munich Re Foundation and will take place alongside the 15th International Conference on Inclusive Insurance in Dhaka, Bangladesh.

Follow this link to download the Save the Date and the Agenda and register.

Inclusive Insurance Training Programme for Latin American Supervisors conducted in Spanish

18 – 22 November, San José, Costa Rica

The Training Programme in Inclusive Insurance for Latin American Supervisors is jointly organized by the Superintendencia General de Seguros (SUGESE), the Association of Insurance Supervisors of Latin America (ASSAL), the Access to Insurance Initiative (A2ii), the International Association of Insurance Supervisors (IAIS), and the Toronto Centre.

The programme is designed to help participants understand the importance of a proportional approach to regulation and supervision to improve access to insurance. It also includes case studies from selected jurisdictions that have developed their inclusive insurance markets.

The training is aimed at mid to high-level officials of regulatory and supervisory authorities that participate in the regulation and supervision of microinsurance and inclusive insurance in the Latin American region.

For the first time, this training will be conducted in Spanish. For more information and to register, please follow this link.

A2ii – IAIS Consultation Call on Cloud Computing: Regulatory and Supervisory Approaches

28 November - WebEx Webinar

Advancements in digital technologies bring both benefits and challenges to the insurance industry and the financial sector in general. In recent years, the insurance industry is increasingly adopting cloud computing technology and services to support critical functions such as underwriting and product development, among others. The use of cloud computing also brings risks such as those related to data security and confidentiality and vulnerability of IT systems to cyber-attacks. Its use may, therefore, require additional supervisory requirements.

During this Consultation Call, experts will explore the topic of cloud computing and its implication for supervisors.

For more information on the Call and registration details, please follow this link.

Leadership and Diversity Program for Regulators: scholarship opportunity by A2ii and InsuResilience Global Partnership Secretariat

The A2ii and the InsuResilience Global Partnership are jointly sponsoring the participation of two senior insurance supervisors and high potential women from their authorities at the Leadership and Diversity Program for Regulators developed by Women’s World Banking and faculty from Oxford University’s Saïd Business School. The nine-month experience includes ongoing virtual learning and a week-long intensive at Oxford University’s Saïd Business School (30 April – 5 May 2020). Read more...