A2ii Newsletter 05/20

Welcome! In this newsletter, we provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

The A2ii taking precautionary measures related to COVID-19 (coronavirus)

To safeguard the well-being of the A2ii staff and its partners, the A2ii is cancelling or postponing all physical events originally planned for March through the end of August, and exploring the use of virtual formats when possible. Events that are scheduled to take place from September onwards are currently not affected by this policy. The A2ii will communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Covid-19 adjustments to A2ii activities

Like many other organisations, the Access to Insurance Initiative has made adjustments to our activities in the context of the Covid-19 crisis. To support insurance supervisory authorities throughout these challenging times, we launched a new Covid-19 webinar series, published a supervisory response tracker on our website and a new blog series. We are also looking into converting our training on inclusive insurance organised together with the Toronto Centre into an online format so that the trainings originally planned for Latin America and Asia should be able to take place remotely instead. Our inclusive insurance innovation lab has also moved online, with workshops now being conducted with the country teams from Argentina, India, Morocco and Rwanda.

Taking a longer-term perspective and thinking about the protection gap this pandemic has exposed, the A2ii is also reviewing its activities to see how through advocacy with policymakers, empowering insurance supervisors or otherwise it can play its part in helping to close the protection gap against future pandemics.

- Hannah Grant, Head of the Secretariat -

New on our website

Covid-19 Insurance Supervisory Response Tracker

As the Covid-19 pandemic sweeps through the world, countries and organisations are reacting in different ways. Our team has been following the developments closely, and to stay up to date on this topic, we have created a special page on our website dedicated to tracking supervisory responses.

It will be frequently updated with news (with a focus on insurance-related topics and world regions) and resources (such as webinars and other online types of events). Please feel free to share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter.

Visit the tracker.

A2ii Blog Post | Perspectives on financial inclusion from Belize: An Interview with Alma D. Gomez, Supervisor of Insurance and Pensions at the OSIPP

We recently interviewed Alma Gomez, who is the Supervisor of Insurance and Pensions at the Office of the Supervisor of Insurance & Private Pensions (OSIPP) of Belize, and who was awarded a scholarship by the A2ii to participate in the Women’s World Banking Leadership and Diversity Program for Regulators.

She shared a comprehensive overview of the inclusive insurance landscape in her country, current challenges due to the Covid-19 pandemic, and insight into the promotion of women’s financial inclusion.

When asked to comment on what she considers essential in promoting women’s financial inclusion, she says: “Financial education is most essential to promote women’s financial inclusion.

By increasing awareness on what insurance is and how it can assist in financial stability, especially after a catastrophic event, women would be more inclined to try out the product. Through the rural finance project, many women in Belize have been able to access finance and, in most cases have started their own businesses through women's groups. Support for their efforts, purchasing their products by the local markets can help them to develop their own financial stability. Protecting their assets, through insurance, would also help them maintain financial stability should a catastrophic event occur. In general, women’s development lies with the support that the community gives them.”

Click here to read the entire blog post on our website.

Subscribe to our blog mailing list

As always, we want to be a source of current and relevant resources for insurance supervisors. If you have a topic suggestion or proposal for our blog, please contact us at secretariat@a2ii.org.

Recent Events

A2ii presents a panel on the topic of “Increasing resilience against climate and disaster risks – the role of the supervisor”

15 April

Due to the Covid-19 pandemic, the 2nd Alliance for Financial Inclusion (AFI) Inclusive Green Finance (IGF) Working Group Meeting that was meant to be held in Accra, Ghana from 9 – 12 March 2020, was cancelled and converted into a series of virtual sessions. A2ii organised and presented on a panel on the topic of “Increasing resilience against climate and disaster risks – the role of the supervisor” on 15 April.

A2ii explored the various roles insurance supervisors can have in the development of responsible climate risk insurance solutions; not only by adopting proportionate regulatory and supervisory approaches to foster supply and demand of climate risk solutions but also by raising awareness on the topic, bringing together the relevant stakeholders and ensuring the incorporation of responsible insurance solutions in national strategies on disaster risk management. Following the presentation, a country case example was presented by Mr. Kofi Andoh, Deputy Commissioner and Head of Supervision at the National Insurance Commission (NIC) of Ghana. To increase resilience, an agricultural insurance pool was set up in northern Ghana. The NIC is furthermore introducing a national agricultural insurance policy, and with the insurance sector have designed a comprehensive insurance awareness program available in 36 languages to raise awareness about the benefits and the use of insurance more broadly, and climate risk insurance specifically.

Click here to view it on YouTube.

iii-lab National Workshops for Argentina and Rwanda

Held virtually

As a result of Covid-19, the iii-lab’s national workshops planned for March in Rwanda and Argentina had to be cancelled and converted into an online format. The A2ii together with its facilitation partner Reos Partners re-worked the initial program design that was mostly based on face-to-face meetings, with the objective to ensure that teams can start the work under current restrictions. Six online sessions of around 2.5 hours are going to be conducted in total to replace the 2-day face-to-face workshop for the Argentinian and Rwanda teams. Participants will meet using video-conferencing platforms in combination with a digital workspace where participants can collaborate using whiteboards.

The Argentinian and Rwandan teams underwent a technology onboarding session and the lab launched in mid-April. Stakeholders from the insurance industries - regulators, insurers, banks, brokers, and insurer associations – have started analyzing current challenges the teams are facing to making their insurance market more inclusive. In May the two teams will continue the online workshops to discuss current barriers to market development and learn about innovation tools. The Indian and Moroccan teams that met early March in the face-to-face workshop have continued their work and are using the same platforms for exchanging and collaborating as their peers in Rwanda and Argentina.

A2ii-IAIS Consultation Call webinar series on the coronavirus (Covid-19) pandemic and implications for insurance supervisors

2 April, 16 April, 30 April

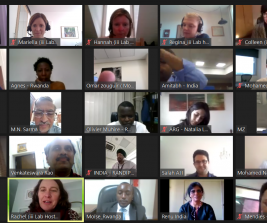

During the month of April, the A2ii saw the launch of its exceptional webinar series on Covid-19 and its implications for supervisors. The far-reaching impact of the pandemic has called for sustained vigilance by both insurers and supervisors. The A2ii-IAIS consultation call webinars have therefore been an opportunity for supervisors to share their expertise and highlight some of the implications for the insurance sector and consumers.

The first webinar in this series provided a holistic overview on the initial impact of Covid-19 on insurers, supervisors and consumers including the uninsured and the most vulnerable. One of the key messages from this webinar was while there are many challenges ahead, this is also an opportunity for the sector to demonstrate how critical insurance is during times of crisis and uncertainty.

On the second webinar in the series, we were fortunate enough to have a supervisory dialogue with supervisors from IRA-Kenya, FSCA-South Africa, CNSF-Mexico, ACAPS-Morocco and SUGESE-Costa Rica. The sharing of best practice amongst supervisors has proven to be invaluable and has highlighted that while regional and domestic differences do exist there can still be similarities in approach. As the Toronto Centre noted during the third webinar, these similarities and differences in approach also extend across the financial sector and how supervisors are key to enabling the market to function effectively. Alongside input from the Toronto Centre, this month’s series ended as it began - with an IAIS presentation but this time the focus was more on a forward-looking assessment of the impact of Covid-19 on the sector. What is becoming increasingly clear is the longer-term impact this crisis will have on the sector.

The next consultation-call webinar will be on the 28 May and we will hear from the OECD on their response to Covid-19 and in particular findings from their survey on consumer protection measures. Keep an eye on our website here for more information and registration details.

Upcoming Events

A2ii-IAIS Consultation Call webinar series on the coronavirus (Covid-19) pandemic and implications for insurance supervisors

28 May

The next consultation-call webinar will be on the 28 May and we will hear from the OECD on their response to Covid-19, and in particular, highlighting findings from their survey on consumer protection measures. Keep an eye on our website here for more information.

Click here to register for the 28 May consultation call.

If you have any suggestions or topics that you would like the A2ii to specifically cover for this webinar series on COVID-19, then please don’t hesitate to get in touch via consultation.call@a2ii.org.

Recent Publications

"Reflections and projections: inclusive insurance supervision" - report on lessons from the A2ii 10th Anniversary Conference

We just published "Reflections and projections: inclusive insurance supervision," a report from our 10th Anniversary Conference: High Level Forum and Expert Symposium.

Drawing from 2 days of exchanges among insurance supervisors, development partners and leading experts in inclusive insurance, the report presents the state of the inclusive insurance regulation and supervision, its impact, as well as opportunities and challenges that lie ahead. Read the report to find out what key messages emerged.

For the agenda and the videos from our 10th Anniversary Conference: High-Level Forum and Expert Symposium follow this link: a2ii.org/en/a2ii10

Download the report on the 10th Anniversary Conference now.