Back to Newsletters

Newsletters | 2022

A2ii Newsletter 01/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Theme of the Year | 2022 Dialogues | Recent Events | Upcoming Events | A2ii is Hiring | Blog | In Memoriam | Useful Tools on Our Website

The Sustainable Development Goals are the Theme of the Year

As efforts to move the needle on pandemic recovery and climate action progressed over 2021, two things became clear: Firstly, sustainability issues are now top priorities for both the public and private sector – including insurers. Accordingly, pressure has increased for insurance supervisors to take action and respond accordingly. Secondly, technology is the constant in any solution, be it in helping supervisors do their day-to-day jobs more effectively or in expanding access to insurance. In 2021, we looked across the SDGs and identified nine where insurance could make an impact. This year, continuing this thread, the A2ii will deep-dive into four SDGs in particular:

- SDG 13 Climate Action: We will help supervisors shape their role in pursuing climate action. Together with the IAIS, we will enable peer exchange on cutting-edge supervisory initiatives, such as climate disclosure. We will help generate practical solutions, through topical research on index insurance as well as hands-on support: facilitating local multistakeholder problem-solving via the climate lab, the third run of our flagship iii-labs.

- SDG 9 Industry, Innovation and Infrastructure: We will equip supervisors with knowledge to navigate a world where digital is the norm. Digital insurance models, RegTech/SupTech, cyber risks and basic knowledge of Industry 4.0 are no longer emerging trends; they are essential competencies. To this end, do look forward to an exciting line-up of regional and global supervisory dialogues.

- SDG 5 Gender Equality: Looking inward is as important as looking outward. Last year, the A2ii took an honest look at where and how our work incorporates gender perspectives. This year, we wish to put theory into practice and ensure that gender is mainstreamed across our activities and content, while addressing specific gaps: among other resources, we will develop a toolkit for supervisors on gender-disaggregated data.

- SDG 1 No Poverty: Finally, we will continue to stay focused on our mission of promoting access to insurance and building resilience of vulnerable groups. In 2022, we will update our inclusive insurance training to ensure we provide supervisors with up-to-date learning experiences and information. And we will double down on efforts to shine a light on the protection gap by looking at two key groups: women and migrants.

We hope you will join us in our efforts and as always, welcome your input.

Pencil in: 2022 A2ii-IAIS Dialogues

In 2022, you can look forward to new insights and rich discussions of the following Supervisory and Public Dialogues line-up:

- Climate-related financial disclosure and Implications for supervisors (SDG 13), 27 January– the first Dialogue of 2022 on 27 January zeros in on the IAIS and SIF Issues Paper on the Implementation of the Recommendations of the Task Force on Climate-related Financial Disclosures. The paper provides an overview of practices that supervisors have considered in developing climate-related disclosure requirements within their markets. The FSD Africa colleagues will highlight their work plans on ESG regulation and disclosure in select Sub-Saharan African countries.

Look back at this topic in our blog report from the previous Dialogue on Supervision of climate-related risks in the insurance sector.

- AI and emerging regulatory expectations (SDG 9), 7 April– This Dialogue will be based on FSI’s Insights on policy implementation from August 2021 ‘Humans keeping AI in check – emerging regulatory expectations in the financial sector’ dealing with authorities’ expectations and guidance for the use of AI and the related challenges.

- Reflection on the Implementation of IFRS 17, 19 May (tentative) – what challenges supervisors face, and what progress has been made before the IFRS implementation deadline in 2023? We will pick up from our last Supervisory Dialogue on Accounting Standards & IFRS 17: The Role of Insurance Supervisors. Read our blog report on IFRS 17: Implications for supervisors and the industry for a refresher.

- Cyber Resilience, 28 July (tentative). Cyber risks are a growing challenge for the insurance sector (and financial system) and it is within the role of supervisors to address them. Ahead of this event check out the presentations and report on cyber risk in the insurance sector from our last Dialogue on the topic here.

- Regulatory challenges and supervisory demands in facilitating remittance-linked insurance, (SDG 1) 29 September (tentative) – Remittances are increasingly being recognised as a pathway to foster financial inclusion and reach the most vulnerable and poor. However, there is still a regulatory grey area in terms of supervisors’ role. This dialogue will explore the existing regulatory challenges and demands in facilitating remittance-linked insurance.

- In 2020, the A2ii and Cenfri organised a webinar on the potential of remittance-linked insurance products based on Cenfri’s report on the same topic (recording available here).

- Risk-based supervision, 24 November (tentative)– Supervisors have been increasingly refining their solvency standards and gradually moving to more risk-based regimes. This year we pick up from where we left off in our past Dialogue on Landscape of Solvency Regimes in emerging markets into the topic. To add value to Emerging Market and Developing Economy (EMDE) jurisdictions, this year we will also be collaborating with the IAIS to focus on practical considerations on transitioning to RBS and sharing experiences with jurisdictions who have successfully implemented RBS.

Recent events

Financial Inclusion Conference in Guatemala | 8-9 December 2021

On 8-9 December, the first edition of the Financial Inclusion Conference in Guatemala took place, coordinated by the Technical Committee for the Implementation of the National Strategy on Financial Inclusion (ENIF) 2019-2023.

Presentations by national and international experts in financial inclusion took place over the two-day conference. Regina Simões, A2ii, gave a presentation on the first day on “Insurance in the context of financial inclusion.” Videos of the conference presentations can be viewed here. The event was organised under the leadership of the Superintendencia de Bancos de Guatemala - SIB (Insurance Authority), the Ministry of Economy and the Bank of Guatemala.

Both days were attended by members of the Technical Committee for the Implementation of the National Financial Inclusion Strategy: Dr. Héctor Valle, Executive Secretary of the Financial Inclusion Commission (COMIF); Sigfrido Lee, Vice Minister of Development of Micro, Small and Medium Enterprises of the Ministry of Economy; and Italo Chicas, Coordinator of the Technical Committee for Implementation, who gave welcoming and closing remarks during the event. The Resident Representative of the United Nations Development Programme (UNDP) in Guatemala, Ana María Díaz, also participated in the event.

BIS Virtual High-level meeting on Financial Inclusion | 1 December 2021

A2ii attended the virtual high-level meeting on financial inclusion on 1 December 2021. It was co-chaired by Agustín Carstens, General Manager of the Bank for International Settlements (BIS), and HM Queen Máxima of the Netherlands in her capacity as the UN Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA). The biennial high-level meeting is part of the activities of the enhanced cooperation arrangements between the BIS, the standard-setting bodies (SSBs) and the financial inclusion community.

About 45 senior level participants attended, with the discussion focused on focused on two topics: i) unintended consequences of global standards for financial inclusion and ii) central bank digital currencies (CBDCs).

On the first topic, discussion centred on whether global standards had unintended consequences for financial inclusion and whether they allow for proportionate application. Overall, it was felt that standards allow enough flexibility, although issues might arise with implementation. The proportionality principle was most likely to be applied in developed countries - that generally needed it least - than in developing countries. In addition, although most global standards allow flexibility for proportionate application, there are no real incentives to implement proportionately, and developing countries need more capacity and guidance on the proportional application of global standards. These findings are further elaborated in a report published by the Financial Action Task Force in October 2021 looking at the unintended consequences of its standards.

Upcoming events

A2ii-IAIS Supervisory Dialogue on Climate-related Financial Disclosure and Implications for Supervisors | 27 January

Climate change poses significant risks that may affect the financial system's broader stability, including the insurance sector. While climate-related risks are expected to materialise over time, it is important that the insurance industry better understand and assess such risks and potential future impacts. Supervisors are within their role and mandate to ensure that the financial system remains resilient to climate risks. Since its conception, the Task Force on Climate-Related Financial Disclosures (TCFD) framework has helped inform practices related to climate-risk disclosure and approaches that supervisors can leverage.

On 27 January, the A2ii and IAIS will be hosting a supervisory dialogue on Climate-related Financial Disclosure and Implications for Supervisors. Participants will hear from experts from theSustainable Insurance Forum (SIF) who will highlight key messages from the joint IAIS-SIF Issues Paper on the Implementation of the Recommendations of the Task Force on Climate-related Financial Disclosures.

The paper provides an overview of practices that supervisors have considered in developing climate-related disclosure requirements within their markets. Participants will also hear from FSD Africa about their work on ESG regulation and disclosure in select Sub-Saharan Africa countries.

This webinar will be open to supervisors only and will take place at 10:00 CET in English (with simultaneous French interpretation) and one at 16:00 CET in English (with simultaneous Spanish interpretation). It will last one hour and will take place via WebEx. If you have any questions or comments, please send them to dialogues@a2ii.org. Click here to register.

IAIS-A2ii-SARB-FSI Regional Meeting for Sub-Saharan African Supervisors | 24-25 February 2022

The upcoming regional meeting for Sub-Saharan Africa insurance supervisors will be organised virtually and hosted by the International Association of Insurance Supervisors (IAIS), the Prudential Authority within the South African Reserve Bank, the Financial Stability Institute and the Access to Insurance Initiative.

As a representative of an insurance supervisor in Sub-Saharan Africa, your participation in this workshop will be very valuable. We hope that you will be able to join us.

The regional meeting will take the format of 3-hour sessions over two days (24 and 25 February 2022) and will be hosted virtually from 9:00 am to 12:00 pm.

Click here to register.

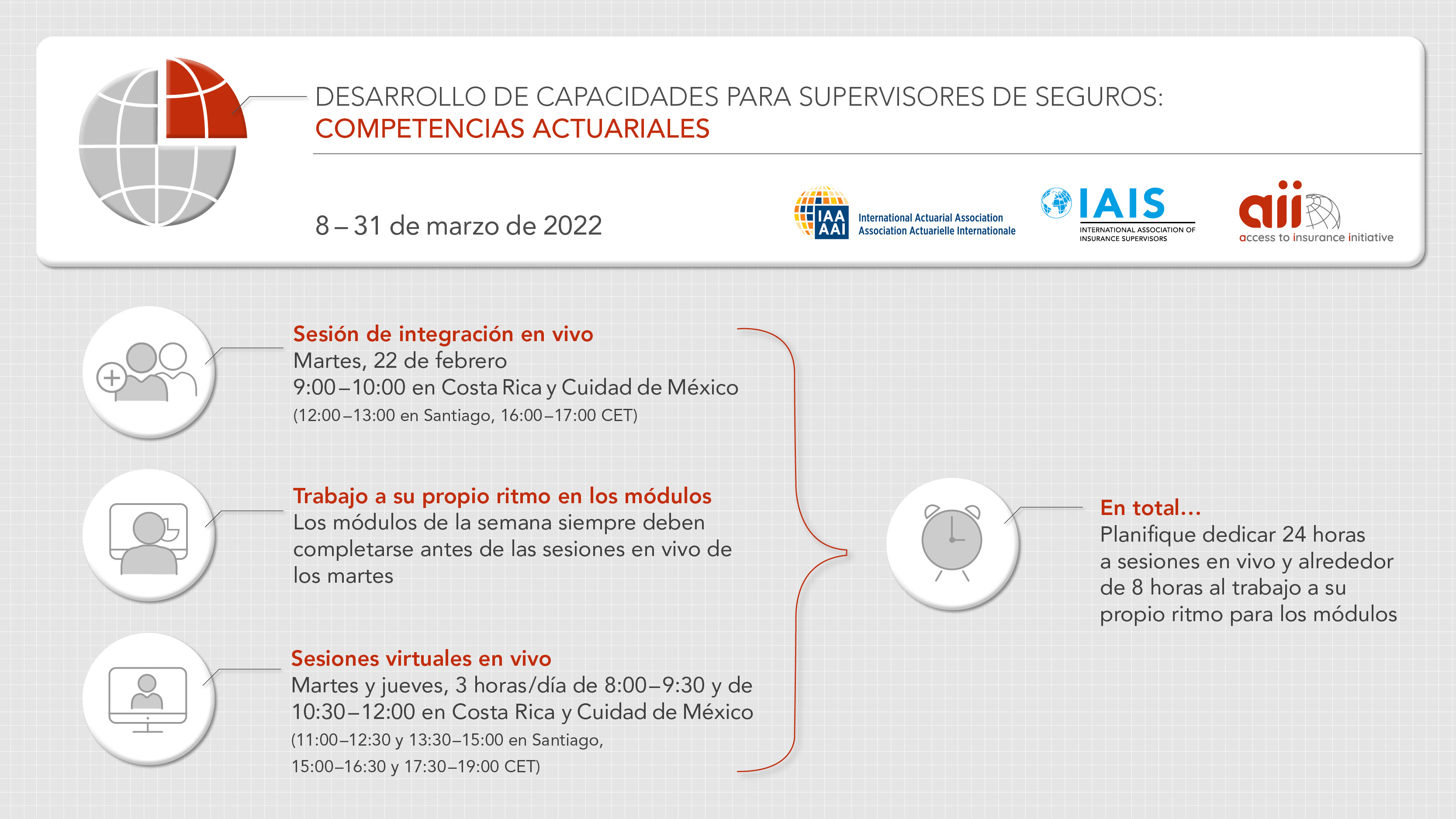

Desarrollo de capacidades para supervisores de seguros: competencias actuariales | 8-31 de marzo de 2022

Nos complace invitarlo a la capacitación virtual “Desarrollo de capacidades para supervisores de seguros: competencias actuariales”, organizada por la Asociación Actuarial Internacional (IAA), la Asociación Internacional de Supervisores de Seguros (IAIS) y la Iniciativa de Acceso a Seguros (A2ii).

La capacitación está dirigida a supervisores de América Latina. Su objetivo es fortalecer la comprensión y la aplicación de los conceptos y herramientas actuariales necesarios para respaldar una supervisión y regulación de seguros efectivas.

El enfoque y el abordaje de la capacitación se centrarán en principios de enseñanza, al mismo tiempo que será lo más práctica y simple posible.

La capacitación se lleva a cabo durante ocho días entre el 8 al 31 de marzo de 2022 con una combinación de módulos de aprendizaje adaptada al ritmo de cada uno y sesiones virtuales en vivo, que incluyen una variedad de sesiones basadas en conferencias, estudios de casos, sesiones grupales y cuestionarios.

Las plazas son limitadas. Haga clic aquí para ver más.

A2ii is hiring

The A2ii is looking for a new advisor. The ideal candidate will:

- Take the lead on different A2ii capacity building formats, including virtual dialogue events, webinars and trainings

- Management and implementation of existing formats in close cooperation with A2ii partner institutions

- Ongoing review and improvement of existing programmes especially in consideration of new virtual tools such as the A2ii e-learning and networking platform for supervisors “connect.a2ii”

- Research and create knowledge on regulation and supervision with a focus on inclusive insurance and emerging risks, including insurance in the context of the Sustainable Development Goals

- Support the A2ii’s donor engagement and prepare tailored funding proposals

- Represent the A2ii at relevant regional and global events

- Bringing great ideas to a welcoming team.

Please apply via the GIZ e-recruiting system before 1 February 2022.

Blog

Navigating the SDGs | A2ii-IAIS Public Dialogue

By Pascale Lamb

When you scrutinise the 17 Sustainable Development Goals (SDGs) and their accompanying targets, you will see inclusive growth, food security, climate action and health – among other goals.

But what you will not necessarily see is the mechanisms and tools behind those goals that deliver the change needed in order to attain them.

Access to insurance is just one of those mechanisms playing a vital role in attaining the goals and as her majesty UNSGSA Queen Máxima highlighted during her pre-recorded keynote address to the recent A2ii-IAIS Public Dialogue. Read more…

An End-of-Year Message from Hannah Grant, Head of the A2ii Secretariat

There are times when the story of life seems to be on fast forward. The year 2021 has seen scientists rally together to roll out vaccines in record time and power up the fight against the pandemic. Amid growing awareness of the looming climate crisis, we have seen an increased focus on innovation and digitalisation - opening new horizons in both reach and impact. Read more…

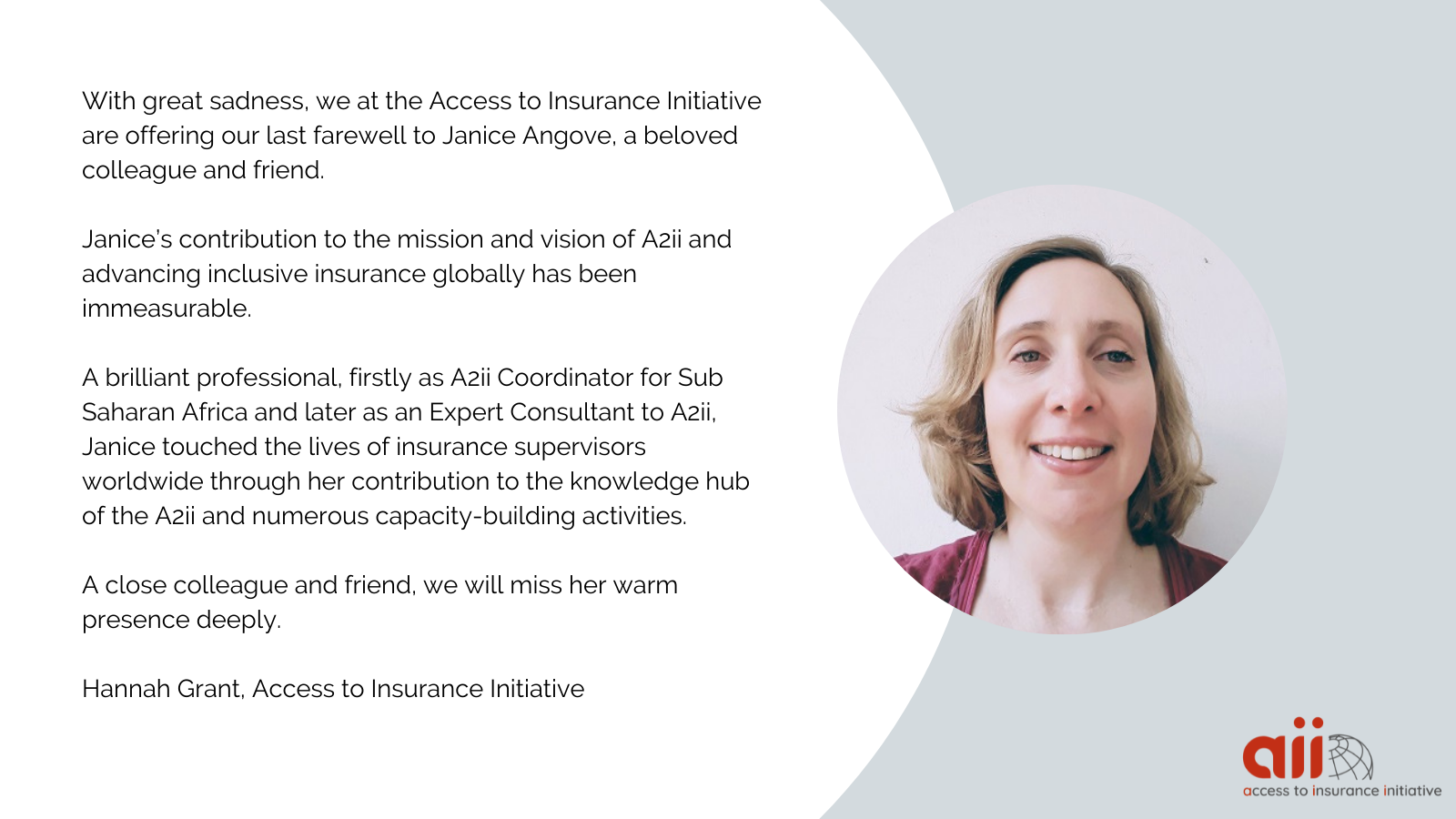

In Memoriam

The A2ii mourns the loss of Janice Angove

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).