A2ii Newsletter 12/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Connect.A2ii | Recent Events | Upcoming Events | Publications | Blogs | Regulatory Updates | Staffing Updates | Useful Tools on Our Website

Connect.A2ii

Training modules on gender lens in inclusive insurance now open to the public

The two gender training modules released this year, and developed with the support of the Swiss Agency for Development and Cooperation, are now open to the public, without the need to create a Connect.A2ii account. The content of this training, initially developed to support insurance supervisors, is also very relevant for other stakeholders in the inclusive insurance market development.

The two modules are a product of the project 'Empowering supervisors to improve women's access to insurance' supported by Swiss Development Cooperation (SDC). Read more about this funding partnership here.

Recent events

Session on the iii-lab at the IAIS Annual Conference I 9 November

A2ii participated in the main annual event of the IAIS, the 2022 Annual Conference, Regina Simões, A2ii Regional Coordinator for Latin America, served as one of the masters of ceremonies.

This year, the conference featured a lunch session on the A2ii’s Inclusive Insurance Innovation Lab. Hannah Grant hosted the session, introducing the A2ii’s objectives in setting up the iii-lab and the innovative design thinking methodology used. Examples of some of the achievements so far from three countries - Ghana, Costa Rica, and Zimbabwe - were then presented by supervisors who were participants in previous iii-labs.

Ghana produced two prototypes - one on Micro and Small Business (MSB) Clinics and one on creating a seamless customer journey with a customer-centric approach.

Fu-Turismo, Costa Rica's prototype, is a web-based open platform for small hoteliers to increase resilience of their businesses through risk assessments and sustainable solutions.

Zimbabwe's Farmers' Basket addresses affordable Area Yield Index Insurance (AYII) with inputs like pesticides, fertilizers, and irrigation equipment.

About the iii-lab

The lab is a one-year global programme, where four country teams work together to develop and implement innovations that advance inclusive insurance in their countries. So far, there have been 147 participants from 12 countries with 19 prototypes developed.

To find out more about the work that has happened with the three iii-lab iterations so far, visit the iii-lab page on our website and make sure to watch the latest video.

Capacity Building for Insurance Supervisors - Leveraging Actuarial Skills I 1-24 November

The A2ii, in partnership with the International Actuarial Association (IAA) and the IAIS, held the second fully virtual English Actuarial skills training for insurance supervisors. There were 42 participating supervisors from 16 jurisdictions who engaged in a blend of self-paced modules from the recently launched Self-Directed Leveraging Actuarial Skills Training on the A2ii learning platform and virtual live sessions held twice weekly from 1 to 24 November.

The live sessions included a variety of expert presentations, case studies, group sessions and quizzes. Participants learned about the principles of actuarial concepts and acquired tools for effective insurance supervision and regulation. Topics covered included risk management, valuation reports, reinsurance, risk-based capital, as well as key performance indicators to monitor for risk-based solvency. Throughout the training, participants worked on action plans designed to address a challenge in their jurisdiction and presented the plans to their peers and the expert trainers on the final day.

The sessions were taught by Jeff Blacker as the lead trainer, Craig Thorburn (World Bank), Elias Omondi (FSD Africa), and Eamon Kelly, as well as the IAA volunteers Fred Rowley, Britta Hay, Jules Gribble, Alex Kühnast and Nigel Bowman. Peter Windsor, from the IMF, also participated in a Q&A session with the participants on IFRS 17.

For more information on the training, see the programme on the A2ii website. The self-directed component of the Leveraging Actuarial Skills Training course is available free of charge to insurance supervisors to enrol at any time.

Panel on Inclusive Insurance at European Microfinance Week | 17 November

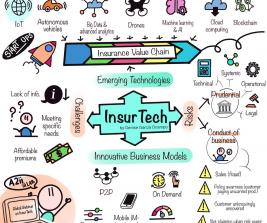

At European Microfinance Week, Hannah Grant spoke at the panel on ‘Inclusive Insurance: Tech-based innovations to scale up inclusive insurance and climate risk insurance’, organised by the International Labour Organisation and moderated by Pranav Prashad.

She highlighted the important role of insurance supervisors in supporting market development, all the while ensuring the protection of vulnerable consumers:

The digital financial inclusion wave comes with innovative approaches to scaling up inclusive insurance and reaching the most vulnerable. These do not come without risks (i.e. exclusion), and supervisors are performing a balancing act to encourage, allow and facilitate innovation with careful consideration of these risks.

The co-panellists were Hugo Lecué, AFD, who presented on the relevance of inclusive insurance in the context of financial inclusion, Ovia Tuhairwe, Radiant Yacu Microinsurance Company who spoke about their parametric products for smallholder farmers and Pedro Pinheiro, Microinsurance Network and IDF who discussed multistakeholder partnerships facilitating insurance provision.

Risk-based Supervision – A2ii-IAIS Supervisory Dialogue | 1 December

On 1 December, the supervisory dialogue on risk based supervision took place. This dialogue was a continuation of the dialogue that took place in 2021 on risk based capital regimes in emerging markets (report available).

During this session, Peter Windsor, Senior Financial Sector Expert provided some insights from the IAIS Annual Conference workshop on the same topic, focusing on the drivers for jurisdictions to move towards risk-based supervision, and the key take aways for jurisdictions in doing so.

After this presentation, he moderated a panel discussion joined by Alma Gomez, Supervisor of Insurance, International Insurance and Pensions (Supervisor of Insurance and Pensions Belize), Asmaa Jabri, Director of Insurance Supervision and RBS Project Manager (ACAPS – Morocco) and Edith Apoo, Senior Risk and Actuarial Officer (IRA Uganda).

Panelists presented on the current status of the implementation of RBS in each jurisdiction, and answered questions around challenges, lessons and recommendations for jurisdictions wanting to implement RBS.

The recording of this session will be available to supervisors in our learning platform Connect.A2ii shortly, as well as the recording from the IAIS Annual Conference session.

Regulators Retreat for Africa | 1 December

The Regulators Retreat for Africa took place in Arusha, Tanzania. It was organised by the Africa College of Insurance and Social Protection (ACISP), Organization of African Insurance Supervisors Association (OAISA) and Tanzania Insurance Regulatory Authority (TIRA). The theme of the retreat was: Africa Insurance: Winning Together in ACFTA, and it brought together regulators to reflect on the insurance industry in Africa, the Africa Continental Free Trade Area (AfCTA) and the need to deliver on economic justice and rights as a vehicle towards the realisation of gender equality and the empowerment of women.

Sharon Sikhosana, A2ii Regional Coordinator for Sub-Saharan Africa, and Lulama Mafunda, A2ii Deputy Regional Coordinator, gave a session on Innovation hubs and Regulatory Sandboxes where they especially highlighted A2ii’s experience working on the Inclusive Insurance Innovation Lab, followed by a Q&A session.

Upcoming events

GCAF Seminar in Rabat | 26-27 January 2023

The French-speaking supervisor’s group GCAF (Groupes des contrôleurs d'assurance francophones) is organising a seminar in Rabat, Morocco on 26 and 27 January 2023, which will be attended by GCAF members from Africa, Europe and North America. A2ii will be leading a session on inclusive insurance during the seminar.

Publications

El papel de los supervisores de seguros en impulsar el acceso de las mujeres a los seguros

Ya está disponible la versión en español del informe El papel de los supervisores de seguros para impulsar el acceso de las mujeres a los seguros. La publicación también está disponible en francés e inglés. Haga clic aquí para descargar el informe.

The Spanish version of the report The Role of Insurance Supervisors in Boosting Women's Access to Insurance is now available. The publication is also available in French. Click here to download the report in our knowledge hub.

Blogs

The current status of women’s access to insurance - an interview

In an interview, Katherine Miles and Manoj Pandey discuss the report on The Role of Insurance Supervisors in Boosting Women’s Access to Insurance and what supervisors, as well as the insurance industry, can do to increase women’s access to insurance. Read more…

Remittance-linked insurance

This blog is based on the September A2ii-IAIS Public Dialogue on Regulatory challenges and supervisory demands in facilitating remittance-linked insurance – the recording is available on our website.

Although in the last couple of years there has been an increase in interest in migrant insurance and social protection schemes, migrants are still a new target group for inclusive insurance.

Remittances often function as insurance (and pensions) when there is a gap of protection in the home country. However, if an unforeseen event occurs such as a migrant worker losing their job or falling sick, then this essential form of protection for families back home is lost; this is why having an insurance protection linked to the remittance channel is so valuable.

In fact, SDG 10 features remittances as one of the central topics of the development agenda, which states: ‘By 2030, reduce to less than 3% the transaction costs of migrant remittances’. Read more…

Regulatory Updates

Bolivia and Paraguay issue inclusive insurance and microinsurance regulations

In case you missed it, the A2ii recently published a newsflash with details of Bolivia’s new inclusive insurance regulation and Paraguay’s new microinsurance regulation. Click here to read on our website.

Staffing Updates

Manoj Pandey, our former Advisor, has taken up a new position with the V20 Sustainable Insurance Facility, alongside which he will continue to provide consultant support to the A2ii’s activities. Manoj was A2ii’s lead on gender and recently helped bring the two training modules on gender to fruition. He also worked on the topics of InsurTech and digital insurance and the Inclusive Insurance Innovation Lab. We wish him the best and are grateful for his time with us - and are glad we will be able to continue to draw on his support as an expert consultant in the future!

Lukas Keller, our former policy advisor, has taken up a new position working on financial inclusion at GIZ, the main German development agency. Lukas was responsible for donor engagement and policymaker’s work at A2ii, and had a focus on pensions and health insurance. He also represented the A2ii at the GPFI (Global Partnership for Financial Inclusion). We wish him the best moving forward and are grateful for the contributions he has made to the A2ii!

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals, with four accompanying handbooks.

Inclusive Insurance Regulations Map

The interactive map incorporates data about regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide. The map is by no means exhaustive and the information within is continuously updated to the best of A2ii's knowledge. A2ii welcomes supervisory input to the map; please send your comments, questions or interventions to secretariat@a2ii.org.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).