A2ii Newsletter 06/22

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

iii-lab Update | Recent Events | Upcoming Events | Connect.A2ii | Staffing Updates | Useful Tools on Our Website

iii-lab Update

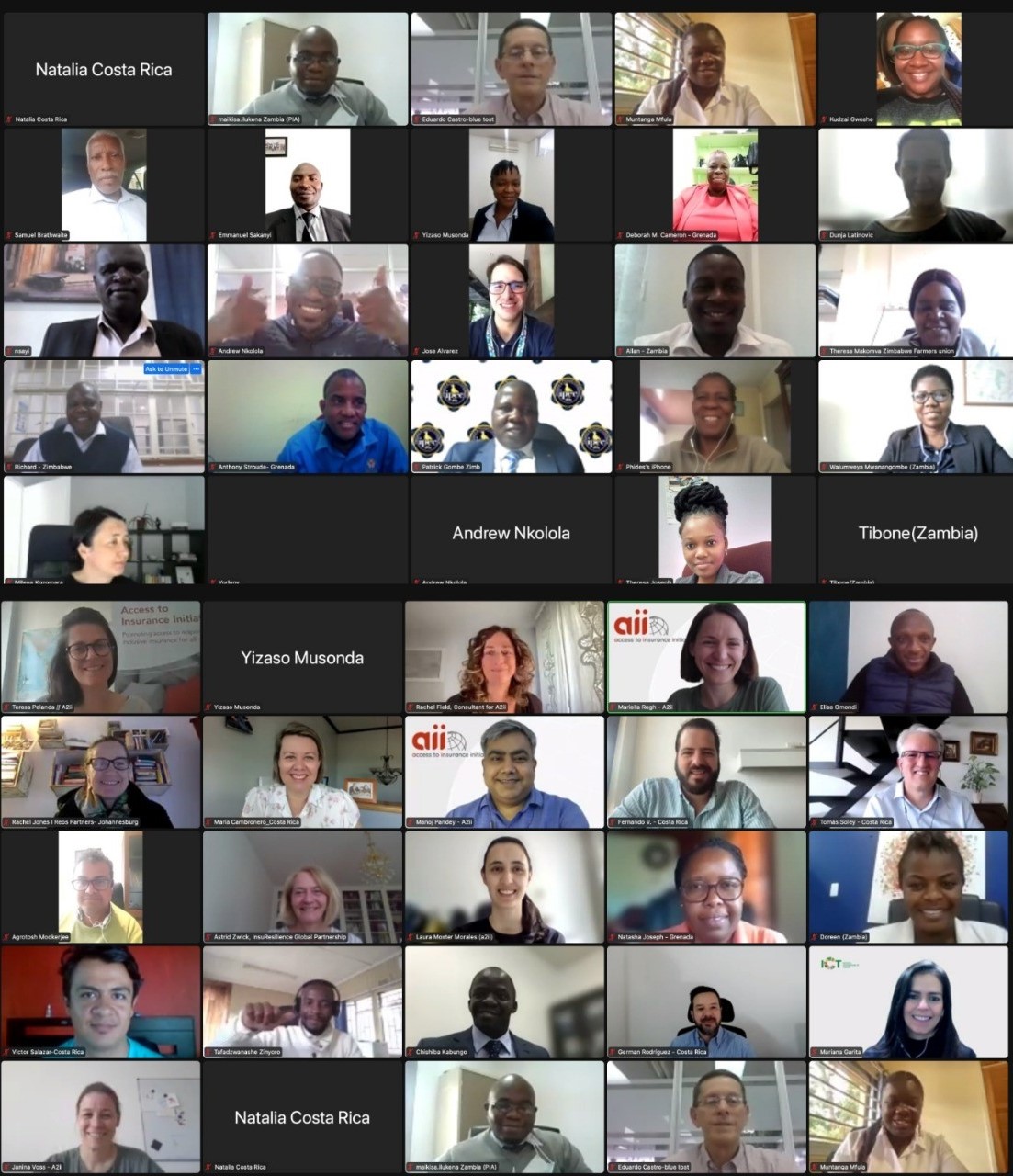

iii-lab teams pitch their initial prototypes to expert panel | 3-4 May

Since mid-March, inclusive insurance innovation lab (iii-lab) country teams from Costa Rica, Grenada, Zambia and Zimbabwe have been working on their initial prototypes aimed at increasing resilience against climate risks in their jurisdictions.

On 3 and 4 May, the teams pitched their prototypes to a panel of experts: Rachel Field (R.K. FIELD, LLC), Hannah Grant (Access to Insurance Initiative), Agrotosh Mookerjee (Risk Shield), Elias Omondi (FSD Africa) and Shilpi Shastri (Winclusivity). Building on constructive feedback and suggestions by the panel members, the teams are now moving forward with the development of their prototypes.

- Costa Rica is working on a climate tool called Fu-Turismo that aims at building awareness of climate change in the tourism sector while at the same time promoting risk reduction and coverage solutions.

- Grenada’s prototype, The Grenada Pan Cooperative Resilience Fund, takes advantage of a strong and well-organised cooperative sector in the country. It is planned to develop a mutual risk pool that provides direct relief to farmers and fisherfolk after a declared climate-related disaster.

- Zambia’s prototype focuses on raising awareness of insurance, especially among the most vulnerable in the agricultural sector (youth and women). Their solution looks at engaging with community champions to disseminate relevant information.

- Zimbabwe proposes a bundled product that combines index insurance with other non-financial products and services like agronomic and weather advice. To address low financial education rates, this will be accompanied by a multi-stakeholder awareness campaign.

In terms of next steps, ahead of the implementation phase in June, teams will complete the innovation phase with the development of a prototyping roadmap.

Recent events

Decentralised Insurance Conference | Amsterdam | 21 April

The A2ii participated in the Decentralised Insurance Conference (D1Conf) hosted by Etherisc and Nexus Mutual during Devconnect in Amsterdam on 21 April. D1Conf centred on how blockchain technology can be applied in insurance, particularly inclusive insurance. The event bridged interested stakeholders across the insurance and decentralised finance worlds.

Presentations kicked off with the Microinsurance Network introducing the concept of SUAVE (simple, understood, accessible, valuable, efficient) in inclusive insurance. This was reinforced by presentations from PULA and Acre Africa, where Acre Africa shared how Etherisc’s blockchain platform was deployed in their weather index insurance product in Kenya. The Lemonade Foundation shared about upcoming advances in the climate risk insurance and blockchain space via the Lemonade Crypto Climate Coalition (L3C). The audience also heard about continuing progress in the technical aspects: An interesting idea for regulators was a A43’s risk matrix that can quantify and qualify risks facing protocols.

A key question confronting the decentralised insurance community is: How will regulators approach decentralised insurance models? A2ii’s Hui Lin Chiew presented on the objectives of insurance regulation, how regulators are responding to innovations, and some grey areas relating to decentralised insurance. Hui Lin was then joined by Timo Bernau from GSK Stockmann in a closing fireside chat hosted by Etherisc’s Jan Stockhausen, where further regulatory reservations and possible areas of consensus were considered.

NAIC International Forum, Emerging Markets panel discussion on ‘Increasing market access and education’ | Washington DC | 12-13 May

The US National Association of Insurance Commissioners (NAIC) flagship international event took place on 12-13 May. Over the course of the two days, through panel discussions and keynote addresses key developments in the insurance sector and the evolution of insurance regulation around the globe were explored. The sold-out event attracted over 300 people from across the US insurance industry as well as a number of international attendees.

Hannah Grant, Head of the Access to Insurance Initiative joined representatives from Brazilian insurance supervisor (SUSEP), Global Asia Insurance Partnership on the ‘Emerging Markets Panel’ moderated by Marlene Caride, Commissioner, New Jersey Department of Banking and Insurance. The panel discussed trends and challenges in emerging markets and drew parallels with more developed markets such as the US. The opportunity provided by the global pandemic for raising awareness together with improvements in efficiency as a result of technology were felt to provide hope for the future; however, the low interest rate environment along with the persistent low penetration rates remain a key challenge.

A2ii-RFPI/MEFIN-MiN Asia Regional Dialogue on "The Role of Insurance and Data in closing the Climate Risk Protection Gap"| 17 May

The virtual Regional Dialogue hosted by the Access to Insurance Initiative (A2ii), the Microinsurance Network (MiN), and the GIZ-Regulatory Framework Promotion of Pro-poor Insurance Markets in Asia (RFPI) in partnership with the Mutual Exchange Forum on Inclusive Insurance (MEFIN) attracted about 60 insurance stakeholders mainly from the Asian region.

The dialogue explored the role that insurance could play in building resilience against climate change and the ever more frequent occurrence of severe natural disasters. The topic is particularly relevant to developing countries in the Asian region where large portions of the population work in the agricultural sector and, according to World Bank data, 90% of the population are unprotected against the impacts of climate change.

The dialogue narrowed in on the topic of availability of good quality data – something that is often cited as a key challenge to the development of climate risk insurance products. Participants heard from Oasis Hub about the increased availability of open source data and about Etherisc’s use of smart contracts and blockchain technology, to automate and improve efficiency and speed of the insurance value chain. The recording of the dialogue will be available shortly, please keep an eye on the A2ii website.

Reflection on the Implementation of IFRS 17 - Supervisory Dialogue | 19 May

On 19 May, the A2ii and the IAIS hosted a Supervisory Dialogue on Reflection on the Implementation of IFRS 17. The session follows on from the dialogue that took place in January 2021 on the same topic (recordings available on Connect.A2ii as a learning resource).

During these sessions, the challenges and progress that have been made ahead of the implementation deadline of January 2023 were discussed by different experts. Peter Windsor, Senior Financial Expert at the International Monetary Fund provided some background on the global developments and most important supervisory issues of IFRS 17, focusing on the implementation challenges EMDE countries face. He strongly encouraged supervisors to engage with the industry about their readiness to implement IFRS17 to determine whether supervisory action needs to be taken.

Following Peter Windsor’s presentation, there were case studies presented by two regulatory authorities for each session.

During the morning session, Jun Oh and Leron Kwong from the Australian Prudential Regulation Authority (APRA) presented their approach and experience implementing this standard in their jurisdiction. They also shared a case study on life contracts that share profits between policyholders and shareholders. This has been challenging for insurers in Australia because of their complexity and the lack of consensus on how IFRS 17 should be applied and still meet the requirements of the Life Insurance Act 1995 under IFRS 17.

During the afternoon session, David Correia from the Office of Superintendent of Financial Institutions of Canada (OSFI) shared OSFI’s experience with the topic. Correia presented how the implementation project was organised, the changes made to supervisory framework because of IFRS 17, how the transition was prepared, as well some common concerns regarding training of supervisors, capital volatility and data reporting.

For both sessions, Zine Mshengu from the Prudential Authority within the South African Reserve Bank (SARB) presented SARB’s multi-stakeholder approach, for which the interaction with insurers, industry and the tax authority has proven best for implementation of such a process. She also shared the results of a survey conducted with insurers on the implementation actions and challenges they had faced.

During both sessions, the presentations were followed by an active Q&A session moderated by Peter Windsor. The recordings will soon be available on our learning platform for supervisors Connect.A2ii.

The implication of the new Insurance Act on microinsurance uptake in Ghana | 19 May

This Ghana country-workshop was organised by the Microinsurance Network as part of a series of workshops on the countries in the Landscape of Microinsurance. Following a short presentation on the results of the 2021 survey, Hannah Grant, Head of the Access to Insurance Initiative Secretariat moderated a panel discussion on the implications of the new Insurance Act on microinsurance uptake in Ghana. The panel was made up of a broad cross-section of stakeholders from the Ghanaian market with the Deputy Commissioner of the National Insurance Commission, as well as senior representatives from Allianz, BIMA and the Ghanaian Insurance Association.

Overall, feedback on the 2021 Insurance Act was positive. Features such as the ‘innovative insurance licence’ and ‘innovative insurance intermediary licence’ were welcomed as providing considerable scope for the introduction of new business models. Agricultural insurance was also recognised as an area benefiting from the new Act with index insurance included within the regulatory perimeter as well as the establishment of an agricultural fund. Detailed provisions are still to follow in the form of regulations and directives but the positive reactions so far give hope that it should enable access to insurance to significantly more vulnerable Ghanaians.

Upcoming events

Inclusive Insurance Training Programme | 23 August – 15 September

This training programme is offered in partnership with the Toronto Centre and IAIS. It will be offered to supervisors from all regions in English. Live sessions with trainers will take place virtually over 8 days, Tuesdays and Thursdays from 23 August to 15 September 2022, from 13:00 to 17:00 CEST on MS Teams. Participants will also be required to complete online modules on the Connect.A2ii platform.

The training is targeted to entry- to mid- level insurance supervisors.

Topics covered in the training include:

-

Regulation and Supervision Supporting Inclusive Insurance Markets

-

The Role of the Supervisor

-

Prudential Aspects in Inclusive Insurance Supervision

-

Climate and Environmental Risks

-

Understanding the Market and the Environment

-

Uses of Technology in Inclusive Insurance

-

Key Performance Indicators

-

Sustainable Development Goals and Insurance

Places will be limited – if interested, please register on our website.

Conduct and Culture - Supervisory Dialogue | 21 July

Matters related to conduct and culture are of growing importance to both conduct and prudential supervisors, especially in the context of rapidly changing financial markets driven by innovation, changes in consumer expectations and broader societal changes.

The IAIS defines corporate culture as “the set of norms, values, attitudes and behaviors of an insurer that characterises the way in which the insurer conducts its activities” (IAIS, 2021). How does culture shape firm behavior in treating vulnerable customers fairly? How can firms to see purpose in inclusive insurance approaches?

These and other questions will be addressed on 21 July, when the A2ii together with the IAIS will host a Supervisory Dialogue on Conduct and Culture. Lauren Eckermann, Senior Policy Advisor at the IAIS will be presenting the Issues Paper on Insurer Culture, published in November 2021.

The presentation will be followed by a Panel discussion moderated by Charlotte Cross (Chair IAIS Market Conduct Working Group and Financial Conduct Authority UK) who will be sharing supervisory examples on the topic.

This webinar is restricted to insurance supervisors and will be taking place at 10:00 CET (with French interpretation), and at 16:00 CET (with Spanish interpretation).

Link to 10:00 registration

Link to 16:00 registration

Visit our website version.

If you have any questions or comments, please send them to dialogues@a2ii.org

Connect.A2ii

New training resource

The recording from the last Supervisory Dialogue on 'Reflection on the Implementation of IFRS 17' is now available as a training module on Connect.A2ii platform in English.

The recording from last year's dialogue on the same topic can also be found on the platform.

If you already have a Connect.A2ii account, you can find the recording in the Catalgue section. If you don't have an account yet, you can create one here.

Staffing updates

Hui Lin Chiew, our former Advisor, has taken up a new position with Etherisc. Hui Lin was A2ii’s Asia regional contact, technical lead on regulatory impact and market conduct, and spearheaded the recent project with Sub-Saharan African insurance supervisors on supervisory KPIs, as well as piloting in-country capacity building in Nepal. We wish her the best and are grateful for her years with us!

The A2ii warmly welcomes Milena Kozomara as our newest Advisor. Milena will focus on the Inclusive Insurance Innovation Lab and will also support donor engagement and A2ii’s climate-related work. Before joining the A2ii, Milena worked as a Project Development Manager for Green Climate Fund at GIZ. Prior to that, she worked at the UN system for various UNDP offices, UN Women and UN FAO. She holds a B.Sc in Spatial Planning from Belgrade University and an MA in International Environmental Policy from Monterey Institute of International Studies (California, US).

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals, with four accompanying handbooks.

Inclusive Insurance Regulations Map

The interactive map incorporates data about existing inclusive insurance regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).