Access to Insurance Initiative Newsletter 8/2017

Welcome to our monthly newsletter, where we update insurance regulators and supervisors on the work of the Initiative, inform you about events and publications, and share experiences and learning across jurisdictions.

Visit us at www.a2ii.org.

Recent Events

Regional Learning Sessions: Inclusive Insurance Business Models for Africa

29-30 August, Kigali Rwanda

Around 80 representatives from the insurance industry, insurance supervisors and development agencies from Eastern and Southern Africa and further afield gathered in Kigali to share insights on inclusive insurance business models serving low-income market segments in Africa.

The first panel focused on the landscape of microinsurance in Africa where the Munich Re foundation gave an overview of microinsurance in Africa, Access to Finance Rwanda provided insights into the microinsurance market in Rwanda and the A2ii gave an overview of inclusive insurance regulatory frameworks in Sub-Saharan Africa.

The A2ii also moderated a panel on inclusive insurance regulation. On the panel insurance supervisors from Kenya and Zimbabwe shared their experiences around supporting the development of inclusive insurance markets. Cenfri also presented an overview of different regulatory approaches to supporting responsible innovation. The discussion focused on:

-

Different approaches to formalisation of informal insurance providers

-

Supervising life and non-life business and the possibility of issuing composite microinsurance products

-

The challenge of keeping exclusions for microinsurance policies minimal whilst at the same time using exclusions to manage product risks during the product approval process.

-

Going beyond regulatory frameworks to develop tools for the supervision of microinsurance business

-

The role of the supervisor in supporting innovation and developing the market whilst at the same time protecting consumers in the context of mobile insurance when products reach a large number of consumers in a short time but can be quickly withdrawn from the market.

A key message from the learning sessions for insurance supervisors is that supervisors need to create the framework in which the industry operates but they must leave the industry to fill in the rest of the picture.

The learning sessions also covered a number of other topical issues in inclusive insurance including: strategy and business modelling, health insurance, agricultural insurance, using data to gain insights on client value and business viability, distribution and technology, consumer education.

The event was organized and hosted by Access to Finance Rwanda, Munich Re Foundation and Rwanda Insurers Association (ASSAR) with support from ILO’s Impact Insurance Facility, Centre for Financial Regulation and Inclusion (Cenfri) and Financial Sector Deepening Africa (FSDA), Microinsurance Network and Access to Insurance Initiative (A2ii).

IAIS Product Oversight Drafting Group Meeting

28 and 29 August 2017, Hyderabad, India

The drafting group for the IAIS Application Paper on Product Oversight in Inclusive Insurance met in Hyderabad, India. The working group, including the A2ii who participated remotely, discussed the comments received during the public consultation and proposed resolution of the comments. The revised draft will be shared with the IAIS Financial Inclusion Working Group and Market Conduct Working group. A stakeholder feedback session on the proposed resolution of feedback from the public consultation will also be held before finalising the paper.

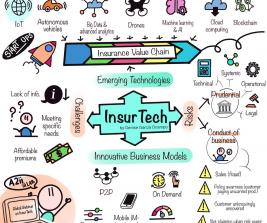

FSD Insurance Community of Practice Workshop on InsurTech and Innovation in Developing Insurance Markets

31 August, Kigali Rwanda

The A2ii Regional Coordinator for Sub-Saharan Africa was invited to attend the Financial Sector Deepening (FSD) Africa workshop on insurtech and innovation which was held along-side the learning sessions on inclusive insurance in Kigali, Rwanda coordinated by Cenfri.

This workshop explored how emerging insurtech models can address challenges to developing inclusive insurance markets. FSD representatives from Kenya, Mozambique, Rwanda, Tanzania, Uganda and Zambia gave input on innovative insurance products that they are supporting in the market. Representatives also shared their needs around research and data gathering to support the development of inclusive insurance their markets. The need for more research around inclusive insurance regulatory frameworks across Africa to support inclusive insurance market development was highlighted.

Recent publications

Spanish version of A2ii publication of Proportionate Regulatory Frameworks in Inclusive Insurance

The A2ii has just published a Spanish translation of its milestone publication 'Proportionate Regulatory Frameworks in Inclusive Insurance: Lessons from a Decade of Microinsurance Regulation'. In this publication, the A2ii looks back at what supervisory approaches have been undertaken since the first microinsurance regulations were put in place then, and draws lessons from the past, as well as looks forward and new trends in inclusive insurance markets and supervisory challenges. The Spanish translation can be found here.

23rd Consultation Call Report published

The report summarises the discussion on the 23rd consultation call on "Proportionate approaches to disclosure of information", the report can be found here.. On the 23rd consultation call we examined the practical aspects of proportionate disclosure regulation, which can encourage the industry to offer inclusive insurance while ensuring consumer protection. The call also leveraged the lessons learned from the recent A2ii study, which was commissioned by the IAIS, entitled “Proportionality in practice: Disclosure of information” which can be downloaded for free here.

Other News

Countries from Asia, East and West Africa and Eastern Europe to participate in the Inclusive Insurance Innovation Lab

The selection process for countries to participate in the Inclusive Insurance Innovation Lab has come to an end, with Ghana (West Africa), Kenya (East Africa), Mongolia (Asia) and Albania (Eastern Europe) being offered a space in the Lab.

The call for applications generated an overwhelming response from supervisors and all applicants were invited to participate in a selection call. The final composition of the group had to balance a wide variety of factors, including regional diversity and diversity of experience with inclusive insurance. The insurance supervisors of the four selected countries will now be supported in putting together their country teams for the Lab process. These teams will consist of around eight senior insurance stakeholders each. In addition to the insurance supervisors, country teams will include the main supply- and demand-side stakeholders in a country.

The Inclusive Insurance Innovation Lab is scheduled to begin in November. Guided by experienced change facilitators, the four country teams will initially explore what the barriers are to greater inclusive insurance market growth in their countries. In a second step, the teams will develop innovative solutions that can increase the uptake of insurance by vulnerable people and businesses.

For more information on the Inclusive Insurance Innovation Lab, please click here or contact anke.green@a2ii.org.