A2ii Newsletter 03/23

Welcome! In this newsletter, we provide you with updates on the work of the A2ii, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

Navigation

Recent Events | Upcoming Events | Partner Opportunities | Staffing Updates | Useful Tools on Our Website

Recent events

A2ii and UNCDF sign an agreement of collaboration

The United Nations Capital Development Fund (UNCDF) and the Access to Insurance Initiative have signed an agreement to drive access to insurance and pensions for migrants, including climate disaster risk insurance. The UNCDF-A2ii collaboration will revolve around research and analysis, stakeholder consultations and networking, and learning and knowledge dissemination.

View the press release here.

Presentation at the EIOPA Eastern Cooperation Conference | 22 March

A2ii participated in the recent EIOPA Eastern Cooperation Conference, a regional outreach event focusing on non-EEA jurisdictions and supervisory authorities from the Eastern European and Western Balkan area. The emphasis was on information sharing, exchange on supervisory experiences, practices, and cooperation as well as possibilities for training and capacity-building for non-EEA jurisdictions.

During the roundtable on information sharing on training and capacity building opportunities, A2ii shared its approach to strengthening supervisory capacity on risk-based supervision and solvency. Highlights of A2ii’s recent work include the self-directed Leveraging Actuarial Skills Training on Connect.A2ii, a Supervisory Dialogue on Risk-based Capital in EMDEs, the Key Performance Indicators Lexicon, and A2ii involvement in the work of the IAIS Risk-based Solvency Implementation Forum.

The conference’s agenda also included a presentation on recent work on the Central and Eastern Europe and the Transcaucasian (CEET) Regional ESG survey. The survey was intended to assess the current status of integrating ESG aspects into insurance regulations in the CEET region. Several challenges were identified including availability of data, the need for a sustainable financial ecosystem, awareness, governance issues, and resources. A report based on the survey will later be co-published by A2ii and its partners in the CEET region.

Presentation of the A2ii sex-disaggregated data toolkit at the ASSAL Diversity, Equity, and Inclusion Webinar | 7 March

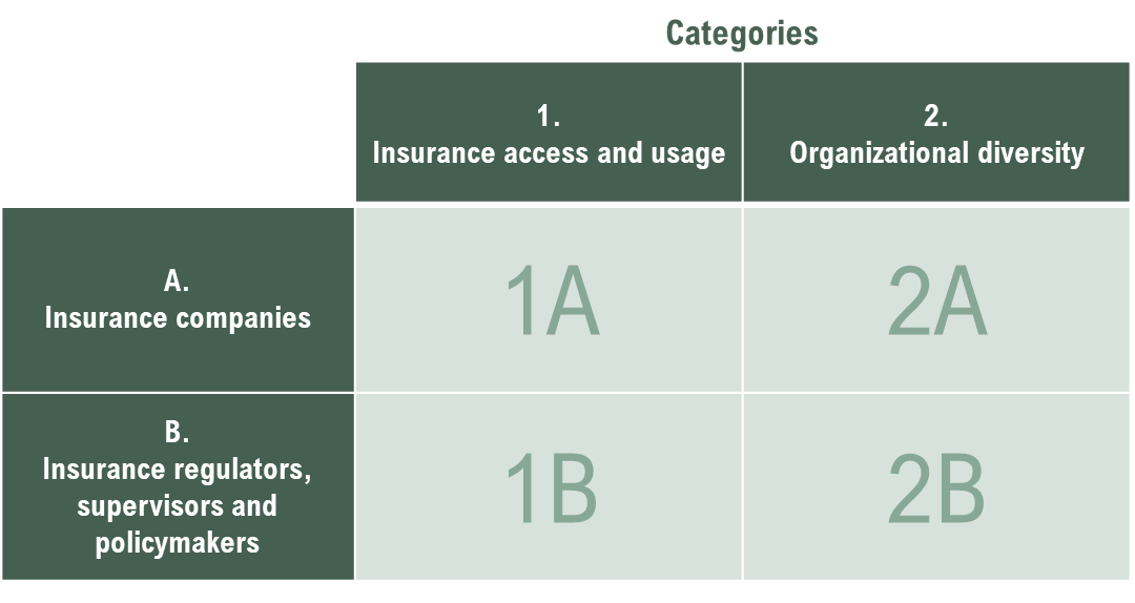

A2ii presented its toolkit for sex-disaggregated data at the ASSAL webinar on “Diversity, Equity and Inclusion (DE&I) as a topic for Insurance Supervisors.” The tool measures key indicators across two categories: insurance access and usage, and organisational diversity. The toolkit is designed to be used by insurance companies, insurance regulators, supervisors and policymakers. A2ii plans to launch a beta-testing phase with insurance supervisors – if you are interested, please contact secretariat@a2ii.org.

Supervisory workshop organised by the Finance Ministry and the Insurance Authority of Togo | 6 March

On 6 March the A2ii presented at a supervisory workshop organised by the Finance Ministry and the Insurance Authority of Togo. The workshop focused on the benefits of microinsurance as a tool for managing the risks faced by low-income households and, in general, those excluded or underserved by conventional insurance. This one-day training session was held in French and led by experts in microinsurance from various backgrounds, including industry and InsurTechs.

Webinar on Digitalisation in Inclusive Insurance - The Role of Supervisors in Meeting the Digital Challenge | 1 March

The ASEAN Insurance Training and Research Institute (AITRI) and A2ii jointly conducted the “Digitalisation in Inclusive Insurance: The Role of Supervisors in Meeting the Digital Challenge” webinar to support the continuous development of ASEAN insurance markets, particularly on the opportunities and benefits that digitalisation can offer. The webinar was formally opened by the interim CEO of AITRI Jaya Kahli and had 53 participants from various insurance regulators mainly from the ASEAN region.

Session 1 dwelt on the topic “How Digitalisation is Re-shaping the Insurance Landscape” where Pascale Lamb (A2ii) explained the current innovation trends affecting the insurance industry including its main drivers, their impact on supervisors, and the role of A2ii in supporting the innovation efforts of supervisors.

Session 2 was on “Regulating Innovation” and featured a presentation on the recently published report of the IAIS which addressed developments and issues particularly on Application programming interface (API) and Open Data, Decentralised Finance, artificial intelligence and machine learning including their current uses by supervisors, business models, and the opportunities and risks that comes with them. The session was presented by Hanne van Voorden, Head of Supervisory Practices and Operations of the IAIS.

Session 3, “Innovative Supervision”, focused on the joint A2ii-IAIS-FSI paper on Suptech in Insurance Supervision in 2022. The first portion of the session was a presentation on paper itself by Jeremy Prenio, Principal Advisor of the BIS, focusing on the current tools used by supervisors in prudential and conduct supervision, the “wish list” of supervisors regarding such tools, and the challenges and requirements for further advancing the use of SupTech tools in the future. The second part dwelt on specific challenges of SupTech facing EMDEs which was presented by Manoj Pandey of the UNEP-V20 Sustainable Insurance Facility. The final portion presented the experience of the South Africa Reserve Bank’s journey in meeting the digital challenge which was presented by Daniel Masiya, Business Transformation Manager.

GPFI Plenary Meeting | 6-7 March

The A2ii attended the second Plenary meeting of the Global Partnership for Financial Inclusion (GPFI) under the G20 India Presidency.

During the Plenary, the GPFI members discussed and agreed on the way forward for important deliverables for the year, including those on Digital Financial Inclusion and SME Finance. A dedicated workshop was also organised for the development of the GPFI Financial Inclusion Action Plan (FIAP) 2023, which will guide the financial inclusion work under G20 for 2024-26. The GPFI Meeting was preceded by a Knowledge and Experience Exchange Programme for the Emerging Economies of the Global South, with the intention of integrating the priorities for emerging markets on financial inclusion into the GPFI’s workplan. The third GPFI Plenary will be taking place in July and will be focusing on the key deliverables for the year.

Upcoming events

A2ii-IAIS Supervisory Dialogue on Diversity, Equity and Inclusion | 25 May

DEI is particularly relevant to governance, culture and conduct, but also to financial inclusion and sustainable economic development as well as innovation and social responsibility.

To make insurance more inclusive to all population groups, reducing inequalities and bringing awareness to the disparities that still occur is crucial. A2ii’s work has focused on making insurance an accessible resource to those excluded from traditional insurance products since the beginning. One example of this has been the work done on making insurance gender aware, such as the sex-disaggregated data toolkit that is being developed. The topic of Diversity, Equity and Inclusion is therefore central to our work.

The IAIS has committed to deepening and strengthening its work on DEI in a number of ways, including exploring the insurance sector's efforts and steps taken by supervisors in support of DEI, incorporating relevant DEI aspects into ongoing IAIS projects and activities, and considering opportunities for cooperation on DEI with other international organisations and partners.

On 25 May, a Supervisory Dialogue on Diversity, Equity and Inclusion will take place. This dialogue will focus on the key insights from the IAIS's Stocktake on diversity, equity and inclusion in the insurance sector published in December 2022. It will also feature supervisors from jurisdictions who have been implementing relevant measures in support of DEI.

This webinar will be open to supervisors only. It will take place on 25 May at 14:00 CEST via Webex and will last 1 hour and 15 minutes. The webinar will have simultaneous interpretation to French and Spanish.

Registration is available here. Stay tuned! Soon we will announce the speakers.

Partner Opportunities

Apply to the NAIC International Fellows Program | 7 April

The National Association of Insurance Commissioners (NAIC) invites insurance supervisors to apply for the NAIC International Fellows VIRTUAL Program, taking place 24-28 April 2023. The program will feature recorded lectures by NAIC technical experts covering all aspects of U.S. state-based insurance regulation, with opportunities for participants to engage with NAIC staff in order to gain deeper insights into how insurance is regulated in the U.S. and the role of the NAIC in supporting state-based regulation.

Applications are open until 7 April. Participation is free for selected applicants – find out more information here.

Staffing Updates

We welcome Mubatsiri Mukome, who joined the A2ii’s team on a secondment from the Insurance and Pensions Commission, Zimbabwe.

Mubatsiri’s working experience lies within the banking and insurance sectors, where he has experience with credit risk management, actuarial valuations and reporting, insurance capital determination, product review and adjustments, and microinsurance. Mubatsiri has also managed projects within the insurance industry, leading technical teams on areas such as developing risk-based solvency regime for the local insurance market in Zimbabwe. He graduated from the University of Pretoria with a BSc Actuarial and Financial Mathematics and BSc (Hons) Mathematical Statistics and is currently pursuing the fellowship designation within the actuarial profession.

We welcome Stephanie Campos to the A2ii team as a Junior Advisor. Her role is to support A2ii communications and capacity building tasks, including the Inclusive Insurance Innovation Lab (iii-lab) and Connect.A2ii training modules. Previously, she interned at the Latin American United Nations Office for Project Services (UNOPS) as a Regional Outreach and Communications Intern and worked on Project Development for the Andres Bello Agreement in Panama City, Panama. She holds a dual degree BBA in Marketing and BEc in International Business from Hofstra University and the Dongbei University of Finance and Economics, and a Specialised Master´s degree in International Cooperation and Development form the Catholic University of the Sacred Heart in Milan, Italy. Stephanie is fluent in English and Spanish and speaks some French and Italian.

Joscha Sisnowski joined the A2ii secretariat as a Junior Advisor in March 2023. He holds a Bachelor (Hons.) in International Politics and Global Development from Aberystwyth University and is pursuing a double degree in Public Policy and Human Development at the United Nations University. Prior to joining the A2ii, Joscha worked in Haiti on local capacity development. He speaks German, English and French.

Useful Tools on Our Website

Insurance and the Sustainable Development Goals (SDGs)

The SDG pages include resources on the importance and the role of insurance across nine SDGs: 01 No Poverty, 10 Reduced Inequalities, 02 Zero Hunger, 03 Good Health and Well-being, 05 Gender Equality, 08 Decent Work and Economic Growth, 09 Industry Innovation and Infrastructure, 13 Climate Change and 17 Partnerships for the Goals.

Supervisory KPIs Lexicon

Interactive, searchable directory of KPIs for insurance supervisors across four pillars: prudential soundness, market conduct, insurance market development and the Sustainable Development Goals, with four accompanying handbooks.

Inclusive Insurance Regulations Map

The interactive map incorporates data about regulation and regulation which supports inclusive insurance sourced through A2ii's research, work and interaction with supervisory authorities worldwide. The map is by no means exhaustive and the information within is continuously updated to the best of A2ii's knowledge. A2ii welcomes supervisory input to the map; please send your comments, questions or interventions to secretariat@a2ii.org.

ICP Self-assessment Tool

The tool is intended to help supervisors assess the level of observance of the Insurance Core Principles (ICPs).