Access to Insurance Initiative Newsletter: 11/2013

Welcome to the fifth issue of our monthly newsletter, where we update insurance regulators and supervisors on the work of the Initiative, inform you about events and publications, and share experiences and learning across jurisdictions.

This month, we focus on the first IAIS-Microinsurance Network Consultative Forum in Jakarta supported by A2ii and conduct an interview with the Indonesian insurance supervisor. Do you have anything to share? Please send us feedback, information or tips for the next issue.

Remember to watch our video clip on the impact achieved through the A2ii-IAIS partnership!

- Access to Insurance Initiative Secretariat team

Supervisors and insurers discuss regulatory implications of various business models

The Annual International Microinsurance Conference is a highlight in the microinsurance calendar. This year it was hosted in Jakarta, Indonesia, with the support of the Indonesian financial services authority, the OJK.

As part of the conference, the IAIS and Microinsurance Network, supported by A2ii, organized a Consultative Forum to provide a platform for public-private dialogue. The first forum focused on microinsurance business models, distribution and regulatory implications and was attended by more than 100 participants from 40 countries.

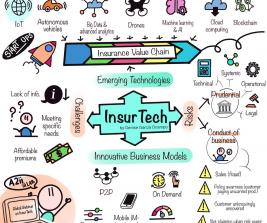

In opening the forum, Peter van den Broeke of the IAIS secretariat reiterated the IAIS’s strong focus on instilling proportionate regulatory practices that also work for the low-income segment. Stefanie Zinsmeyer of the A2ii then presented emerging microinsurance business models, focusing on related risks and regulatory implications for supervisors. The presentation provided a snapshot of an A2ii synthesis note across 25 jurisdictions around the world that will shortly be circulated for consultation with IAIS members via the Financial Inclusion Sub-Committee. Click here for the presentation.

The presentation formed the basis for a panel discussion among supervisors and private sector players on business models that work for the low-income population and their regulatory implications. Distribution by third-party aggregators like retailers, utility companies or mobile network operators is becoming increasingly important. This was confirmed by Commissioner Firdaus Djaelani from the OJK. As aggregators own the client base and provide the sales force, they have strong bargaining power vis-à-vis insurers. They also have non-insurance interests and often operate outside the jurisdiction of insurance supervisors. Collaboration with regulators such as the telecommunications and cooperative authorities is therefore important.

The panelists discussed how to make sure that consumers are protected in such new partnership models. The facilitator, Arup Chatterjee from the Asian Development Bank, stressed that “this is a very new subject and we are currently all learning together”. Supervisory know-how is crucial, as supervisors need to understand new intermediation channels in detail to be able to recognize the associated risks.

A full report on the Consultative Forum will become available soon.

More from Indonesia

As host country for the 9th International Microinsurance Conference, Indonesia has been in the spotlight recently. What are the regulatory challenges and opportunities for inclusive insurance in Indonesia?

We talk to Moch Muchlasin of the OJK

“I believe that communication between the regulator and insurance providers to develop access to insurance should be a high priority. Two-way communication will not only effectively send the message to the target audience, but will give input on stakeholders’ needs and concerns regarding microinsurance.”

Mr Muchlasin is part of the OJK’s Directorate of Sharia Non-Bank Financial Institutions. We caught up with him during the conference to learn more about the OJK’s views on regulation and supervision for inclusive insurance markets in Indonesia.

OJK is committed to the promotion of an inclusive insurance market. They launched a Grand Design for Microinsurance in October that sets out a regulatory roadmap towards microinsurance regulations agreed upon by the OJK and industry players. The next step will be the development and implementation of microinsurance regulation. This phase will be informed by studies regarding product design appropriate to the target market, as well as capacity building for the regulator, insurers and distribution channels.

As part of the groundwork, a Taskforce on Microinsurance Development was set up. It recently completed a preliminary assessment of the demand and supply for microinsurance. Though further research is needed, it is clear that microinsurance is currently concentrated in credit life and personal accident insurance, distributed mainly through the microcredit sector. A key priority is to extend the distribution channels to networks and outlets with a presence in low-income communities.

Click here for the full interview.

Proactively promoting Takaful

Indonesia has the largest Muslim population in the world and is the fifth-largest generator of Takaful premiums globally. Yet Takaful still only represents 3% of the total insurance market in Indonesia. Distribution is still limited to traditional agency channels and bancassurance and other community-based organizations are not yet being tapped. The cost of doing business is high, while the volume of takaful portfolio is small and re-takaful (reinsurance) is not yet sufficiently developed.

In an effort to develop the Takaful market, the OJK has submitted a bill to Congress to regulate Takaful. OJK has also identified microtakaful as one of the priorities for its Grand Design for Microinsurance. RFPI Asia (see below) will provide technical assistance to the OJK on, amongst others, the topic of Takaful as part of the implementation of the Grand Design.

Featured project: Regulatory Framework for Pro-Poor Insurance Markets in Asia (RFPI)

RFPI Asia was set up earlier this year with the objective to introduce proportionate regulatory and supervisory approaches for expanding insurance coverage to low-income people in Asia, by building supervisory capacity and by promoting the development of innovative insurance solutions for the low-income sector.

In doing so, it utilizes the A2ii methodology and the IAIS global tools where relevant.

Based in Manila, Philippines, RFPI Asia is implemented by GIZ on behalf of the German Federal ministry for Economic Cooperation and Development (BMZ). Click here for more.

With support from the Asian Development Bank, RFPI organized a regional Mutual Exchange Forum on Inclusive Insurance (MEFIN) for insurance supervisors, hosted by the Philippine Insurance Commission, in May 2013. This led to the Cebu Declaration on Inclusive Insurance, signed by regulators and supervisors from Indonesia, Mongolia, Nepal, Philippines, Thailand and Vietnam to signify their commitment to inclusive insurance. According to the Program Director, Dr. Antonis Malagardis: ‘The capacity development strategy of RFPI Asia prioritizes the development of trainers and experts on inclusive insurance regulation, in particular in areas such as agriculture, disaster risk management, SMEs and Islamic insurance’.

The Asian Development Bank will also partner with RFPI to conduct thematic diagnostics and recommend interventions for policy reforms and the development of enabling regulatory frameworks for: (a) supporting development of insurance products for better management of exposures to supply chain risks and facilitating access to finance by SMEs without collateral and guarantor; (b) assessing solvency risks for insurers where public private partnerships are fostered to effectively channel premium subsidies by allowing private insurers/ reinsurers to manage microinsurance programs; and (c) understanding the risks imposed on customers in insurance transactions (pre and post sales) due to the proliferation of mobile technology and the required regulatory treatment.

Latin America update: Colombia and Jamaica kick-off workshops

In our September issue, we introduced the Inter-American Development Bank-Multilateral Investment Fund and A2ii Latin America project to enhance financial inclusion in insurance in Peru, Colombia and Jamaica, support supervisors in these countries to develop and implement regulatory roadmaps and organize regional dissemination.

The first findings of the country diagnostics – that of Peru – will be shared at a stakeholder workshop in December.

Recently, kick-off workshops were held in Colombia and Jamaica, hosted by the respective countries’ supervisory agencies.

The Colombia workshop, held on October 18th, emphasized the openness of the supervisor to market views. Though there is no unique regulatory position on inclusive insurance currently, they welcome the project activities as an opportunity to discuss microinsurance issues and show interest in exploring a regulatory response, starting with the development of a definition of microinsurance.

The interest in the topic was also apparent in Jamaica, where almost 120 industry and regulatory representatives attended the workshop on November 4th. The Jamaican Financial Services Commission expressed particular interest in learning more about microinsurance business models and supervisory and regulatory responses to those models in other countries, with specific emphasis on consumer protection regulation.

In brief

Recent events

- 12-14 November, 9th International Microinsurance Conference, Jakarta, Indonesia. Click here for conference presentations.

- 4 November, A2ii/IADB-MIF Latin America Project: Jamaica kick-off workshop, hosted by the Financial Services Commission, Jamaica

Coming up

- Change in date: 16-17 December, A2ii/IADB-MIF Latin America Project: stakeholder workshops to present the findings of the Peru diagnostic, hosted by the Superintendencia de Banca, Seguros y AFP (SBS) Peru

- Jurisdiction reports for the IAIS-A2ii self-assessment and peer review on regulation and supervision supporting inclusive insurance markets: expected early December. Cross-country aggregate report expected first quarter 2014

Meet

Arup Chatterjee, Asian Development Bank

Arup is Senior Financial Sector Specialist at the Asian Development Bank with responsibility for leading financial sector development initiatives in the area of insurance, private pensions and contractual savings in Asia and the Pacific. In his previous role, he served as member of the IAIS secretariat with responsibility for, amongst others, standards implementation and financial inclusion matters. Before that, he was Joint Director at the Insurance Regulatory and Development Authority, India, where he was active in drafting and implementing new regulations and regulatory policy for almost a decade.

Arup has been involved actively with the A2ii since its inception and facilitated the Consultative Forum in Jakarta featured in this month’s newsletter.

An interesting read

A development perspective on risk. The World Bank’s World Development Report 2014, titled “Risk and opportunity”, argues that risk management can be a powerful instrument for development.

Click here for a critical assessment of the report by Karlijn Morsink of the Centre for the Study of African Economies, Oxford University.

Supervisor's corner

Mr Daniel Fola,

Commissioner for Insurance,

National Insurance Commission (NAICOM) Nigeria

NAICOM is fully committed to the promotion of financial inclusion through Takaful and microinsurance.

Following the completion of the Nigeria Microinsurance Diagnostic, the Commission is set to inaugurate a Steering Committee, which will include all stakeholders in the microinsurance value chain, to facilitate microinsurance development under the auspices of the National Financial Inclusion Strategy.

Furthermore, NAICOM is developing a regulatory framework for microinsurance. The aim is to create flexible rules to encourage innovation, while ensuring consumer protection. A core priority will be to establish effective, accessible microinsurance distribution channels.

Click here for a full overview of NAICOM’s activities to support microinsurance development.

Share

Do you have an experience to share? Click here to let us know of any new microinsurance regulatory developments or lessons in your jurisdiction, or join our LinkedIn group and post discussion topics or questions