Access to Insurance Initiative Newsletter: 09/2013

Welcome to the third issue of our monthly newsletter, where we update insurance regulators and supervisors on the work of the Initiative, inform you about events and publications, and share experiences and learning across jurisdictions.

This month, we provide an update on the recent IAIS Implementation Committee meetings in Gibraltar and feature the A2ii-IADB project in Latin America and the work it is doing with the insurance supervisor in Colombia. Do you have anything to share? Please send us feedback, information or tips for the next issue.

- Access to Insurance Initiative Secretariat team

IAIS prepares path for regional implementation focus

The IAIS Implementation Committee Working Parties met in Gibraltar from 3 – 6 September to discuss implementation activities currently underway and to review the IAIS’ draft Coordinated Implementation Framework (CIF). The CIF is a strategic framework, developed by the IAIS Implementation Committee, that will strengthen the delivery and impact of IAIS support for implementation of the Insurance Core Principles (ICPs). The vision underpinning the CIF is “Observance of the ICPs by all IAIS Members, supported by sufficient supervisory knowledge and which recognises the need to support the application of principles in specific circumstances.”

At its core, the draft CIF proposes a more structured approach to regional engagement as means to strengthening a bottom up perspective on implementation needs. This approach will be multifaceted, but focuses on working with regional groups and forums, as well as implementation partners, to identify and then target key regional implementation priorities. It aims to support IAIS Members in understanding their implementation needs by strengthening the alignment of the IAIS’ current implementation activities and building more robust partnerships with implementation partners, such as the A2ii.

The new strategy of the A2ii fits closely in the planned CIF by supporting global, regional and national capacity building based on the proportionate application of the ICPs with the aim to enhance access to insurance. See our article on our joint IADB Latin America project below for a snapshot on how this approach works in practice. Adoption of the draft Framework is expected this October.

If you’d like to learn more about the CIF or share your comments, contact conor.donaldson@bis.org at the IAIS Secretariat.

We talk to the chairman of the IAIS Education Sub-committee (ESC), Mr. Walid Genadry

“The challenge is that one cannot have control on timing of implementation. If you expect quick results you can fail.”

The IAIS Education Sub-committee strives to help supervisors master their profession through various targeted training offers. It assesses the educational and development needs of IAIS members, centralizes information and material relevant to supervisors and facilitates and promotes activities that address supervisors’ needs. Core to the approach is leveraging partnerships with various training and other organizations at global, national and especially regional level.

In this interview, Mr Genadry tells us more about the priorities of the ESC, the training offer, how they ensure that it meets supervisors’ needs and the partnership approach. Click here for the full interview.

Takaful regulation in the context of inclusive insurance markets

Takaful insurance – the Islamic counterpart of conventional insurance, from the Arab for “guaranteeing each other” – is an increasingly relevant topic across jurisdictions. What does it mean for regulation and supervision supporting inclusive insurance markets?

To ensure a level playing field and given the likely sensitivities where financial products structured around religious beliefs are concerned, it is essential that the right regulatory framework be in place for Takaful insurance.

This would require specific regulatory reform that reaches beyond insurance regulation to tax provisions and the recognition in company law of Shari’a boards. For more on Takaful regulation, see the 2006 Islamic Financial Services Board and IAIS Issues Paper in Regulation and Supervision of Takaful.

The IAIS and IFSB have confirmed their intention to work on a new Application Paper on Takaful.

In our next issue we would like to feature supervisory experience on this topic from supervisors. If you would like to be featured Please let us know.

Spotlight on the A2ii-IADB Latin America project

According to a study on the landscape of microinsurance in Latin America and the Caribbean, nearly 45 million lives are covered by microinsurance in the 20 reviewed countries. This shows significant growth compared to data available from 2005. However, the average penetration of microinsurance remains relatively low and is mainly limited to a few countries: of the nearly 45 million people covered by microinsurance, more than 55% live in Mexico and Brazil. Insurance regulation and policy in most countries of the region is oriented towards conventional insurance.

The Inter-American Development Bank (IADB), as administrator of the Multilateral Investment Fund, and the A2ii established a joint regional project to support insurance supervisors of the region to promote access to insurance. The project works with the supervisory authorities of Peru, Colombia and Jamaica. Currently, it undertakes diagnostic studies that look into the drivers, opportunities and barriers in the existing insurance market in order to inform recommendations for regulatory reforms. It will subsequently support the supervisory authorities with the development of a regulatory road map and with targeted training.

The A2ii intends to involve other supervisors of the Latin America region to learn from the experience of these countries and to participate in regional trainings. If you are interested in participating, please email us or contact Maria Victoria Saenz-Samper at the IADB.

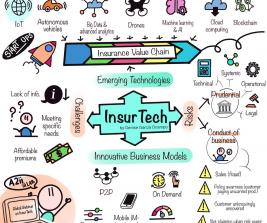

Debating inclusive insurance online: ILO/A2ii Webinar

On 28 August, the A2ii hosted its first webinar in partnership with the ILO Microinsurance Innovation Facility with the topic “Building Inclusive Insurance Markets”. It was attended by more than 120 participants from across the globe.

The webinar incorporated inputs from the IAIS on regulation and supervision supporting inclusive insurance markets, as well as the ILO on phases of market development.

What is an appropriate regulatory and supervisory response for countries at different stages of development? Inputs from Zambia and the Philippines, respectively, highlighted the importance of collaboration between supervisors, regulators, industry players and policy makers in implementing strategies for enhancing inclusive insurance markets. The speakers presented insights on applying a holistic and systematic approach to market development in order to overcome barriers to insurance for the low-income population. In both countries, the insurance supervisor has been a key participant in the process.

If you missed the webinar, click here to access the webinar recording, or click here to access to the presentation slides.

In brief

Recent events

- 10th-11th September: International Microinsurance Conference – Learning Session Nigeria

- 10th-12th September: AFI Global Policy Forum

- Toronto Centre Microinsurance Training Program for Insurance Supervisors, 16 - 20 September 2013 in Tagaytay, Philippines. For more information click here.

Coming up

- IAIS Annual Conference, 14th-16th October, Chinese Taipei. Click here for more information or to register

Meet

Peter van den Broeke

IAIS Secretariat

Peter joined the IAIS Secretariat in April 2011 and has been supporting the IAIS Financial Inclusion Subcommittee since its establishment. He is also member of the Governing Board of the A2ii.

Before moving to the IAIS Peter had a career of more than 20 years in insurance supervision in the Netherlands, most recently as head of department for prudential supervision overseeing around 120 licensed insurers and 75 registered mutuals.

An interesting read

Weak consumer protection can have severe consequences for microinsurance consumers, but also the further development of microinsurance markets as a whole. What are the issues for supervisors to take into account?

Click here for the 2013 GIZ and Microinsurance Network Discussion Paper on Consumer Protection in Microinsurance

Supervisor's corner

The microinsurance

team at the Financial Superintendence of Colombia

In recent years the analysis and promotion of financial inclusion has been a key item on the agenda of the Colombian Government.

There is no regulatory definition of "microinsurance" and no dedicated regulatory framework for microinsurance in Colombia. Thus there is no full and adequate information related to the supply and demand of microinsurance, including products and distribution channels.

In this light, the Financial Superintendence of Colombia has signed an agreement with the Multilateral Investment Fund of the Inter-American Development Bank, the A2ii and the Banca de las Oportunidades to roll out the "Implementation of Regulatory and Supervisory Standards in Microinsurance Markets in Latin America " project in Colombia.

“As supervisory authority, we have great expectations of the project outcome, since it will help bridge the gaps that exist in our jurisdiction, providing us an overview of the insurance landscape in Colombia by identifying the preferences and habits of the people, the obstacles to microinsurance development and the best way to achieve effective financial inclusion.”

- Sandra Milena López Prieto. Asesora, Subdirección de Coordinación Normativa

For a more detailed overview, click here.

Do you have an experience to share? Click here to let us know of any new microinsurance regulatory developments or lessons in your jurisdiction, or join our LinkedIn group and post discussion topics or questions.