Access to Insurance Initiative Newsletter: 10/2013

Welcome to the fourth issue of our monthly newsletter, where we update insurance regulators and supervisors on the work of the Initiative, inform you about events and publications, and share experiences and learning across jurisdictions.

This month, we focus on the IAIS Annual General Conference and tell you about our recent seminars for supervisors. Do you have anything to share? Please send us feedback, information or tips for the next issue.

- Access to Insurance Initiative Secretariat team

Financial inclusion on the IAIS Annual Conference agenda

As part of the IAIS Annual Conference, the A2ii hosted a panel discussion on the path towards increased access to insurance and the new strategic direction of our partnership with the IAIS. The panel was moderated by Maria Victoria Saenz, Lead Project Specialist IDB-MIF.

The panelists were Peter Braumüller, Chair of the IAIS Executive Committee, Jonathan Dixon, Chair of the IAIS Implementation Committee and Chair of the A2ii Governing Council and Sudhin Roy Chowdhury, Member (Life), IRDA India and A2ii Council member.

Peter Braumüller underlined that financial inclusion is a core interest of the IAIS. The IAIS is committed to support its members in improving access to finance by promoting effective regulatory, supervisory and policy approaches and elaborating standards on financial access. Jonathan Dixon emphasized that the IAIS, through the A2ii, will foster tailor-made regulatory approaches, while following how regulatory practices. This allows continuous assessment of what works and will also inspire peer-exchange. Sudhin Roy Chowdhury gave the practical example of how India put processes in place to provide access to insurance also beyond microinsurance. It was highlighted that financial inclusion is not just a topic for emerging and developing markets, but in fact all supervisors should feel responsible for enhancing inclusion, and stimulate the industry to offer products of high value to the client. The audience was very engaged and many questions centered on the role of the insurance supervisors and the tools to supervise innovations.

Watch our exciting new video clip, launched at the conference, on the impact achieved through the A2ii-IAIS partnership.

First IAIS-A2ii financial inclusion training seminars equip supervisors for action

After extensive testing by supervisors, the IAIS-A2ii financial inclusion training module is now ready to go through the IAIS endorsement process. The module will be used to construct regionally relevant and interactive workshops on inclusive insurance, both in- person and online.

The A2ii organised two test seminars to validate the training module in September: integrated with the Toronto Centre leadership seminar in Tagaytay, Philippines, and back -to-back with the IAIS-Financial Stability Institute regional seminar in Livingstone, Zambia. The seminars reached a combined number of 44 supervisors from 24 countries in Asia and Africa.

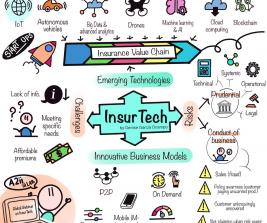

The training focused on various supervisory and regulatory approaches to encourage soundly supervised, inclusive insurance markets. The participants emerged with a better understanding of the differences between regular insurance and microinsurance, the importance of innovation for inclusive financial markets, how sound supervisory principles (IAIS ICPs) can be applied in a manner that encourages inclusiveness in financial markets, and how to promote financial inclusion by encouraging supervisors to be adaptable in their licensing and supervisory roles.

The training focused on various supervisory and regulatory approaches to encourage soundly supervised, inclusive insurance markets. The participants emerged with a better understanding of the differences between regular insurance and microinsurance, the importance of innovation for inclusive financial markets, how sound supervisory principles (IAIS ICPs) can be applied in a manner that encourages inclusiveness in financial markets, and how to promote financial inclusion by encouraging supervisors to be adaptable in their licensing and supervisory roles.

Towards a proportionate response to index-based insurance. Given the challenges of climate change and the fact that a large proportion of the population in many developing countries earns their livelihoods in the agricultural sector, index-based insurance is becoming an increasingly relevant topic. It pushes the boundaries of traditional insurance regulation on a number of fronts. What is the appropriate regulatory and supervisory response to support inclusive agricultural insurance markets? Click here for the case study on index insurance.

Peer learning: the case of the Philippines. Another case study provided a detailed look into the microinsurance regulatory process and contents in the Philippines. The case study proved particularly useful for participants, as it highlighted the practical considerations and steps in devising a microinsurance regulatory response to the particular market features, as well as the importance of intra-government coordination and public-private consultation.

If you are interested in hosting an A2ii seminar on financial inclusion, please send an email to the A2ii or IAIS Secretariat or notify your IAIS regional coordinator.

Featured partner: the Toronto Centre (TC)

Access to Insurance Initiative’s new partner, the Toronto Centre, is a

not-for-profit training organization that builds the capacity of financial sector regulators and supervisors, particularly in emerging markets and low-income countries, to help improve agencies’ crisis preparedness and to promote change that will lead to more sound and inclusive financial systems.

Since its inception, the Centre has trained more than 6,000 regulators and supervisors from 170 countries, and, since 2010, it has tripled the number of its annual training programs from 20 to 60. Toronto Centre’s programming is practical, highly interactive, and action-oriented, with case studies delivered by veteran supervisors who have experienced the situations first hand. Its programs are offered for supervisors and regulators in the sectors of insurance, microinsurance, pensions, securities, banking, and micro-credit. The Toronto Centre is continually designing new programs; it designed and delivered its first program on microinsurance supervision in Namibia in 2012.

The Toronto Centre and the Access to Insurance Initiative looks forward to a future of increased collaboration, delivering a diverse series of programmes to support inclusive insurance markets and concordant supervisory approaches.

In brief

Recent events

-

18 October, A2ii/IADB-MIF Colombia National Workshop, hosted by Superintendencia Financiera

-

16 - 20 September: Toronto Centre Microinsurance Training Program for Insurance Supervisors, Tagaytay, Philippines

-

24-26 September: Financial Stability Institute-IAIS regional seminar, Livingstone, Zambia

Coming up

- 12-14 November, 8th International Microinsurance Conference, Jakarta, Indonesia. Click here for the agenda or to register. Watch this space for an update of the 1st Consultative Forum on business models, distribution and regulatory implications that the A2ii supports back to back with the conference

- 4 November, A2ii/IADB-MIF Latin America Project: Jamaica kick-off workshop, hosted by the Financial Services Commission, Jamaica

- 28 & 29 November, workshops to present the findings of the A2ii/IADB-MIF Peru diagnostic, hosted by the Superintendencia de Banca, Seguros y AFP (SBS)

Meet

Stephanie Siering

Federal Financial Supervisory Authority BaFin, Germany

Stephanie is a Senior Inspector/International Expert in Insurance and Occupational Pensions at BaFin in Bonn. As such, her duties include representing BaFin at IAIS meetings, including on the topic of inclusive insurance.

As one of the founding members of the IAIS MIN Joint Working Group on Microinsurance she is passionate about driving developments in Standard Setting and Standard Implementation to support financial inclusion.

She was an active participant in the drafting group for the IAIS Application Paper on Regulation and Supervision Supporting Inclusive Insurance Markets and chairs the expert group that developed the A2ii-IAIS Self-assessment and Peer Review project on regulation and supervision supporting Inclusive insurance markets.

An interesting read

All you want to know about the A2ii in two pages.

We are excited to share our new Fact Sheet.

Supervisor's corner

Mr Martin Libinga, Registrar

Pensions and Insurance Authority (PIA) Zambia

This month the spotlight falls on the Zambian Pensions and Insurance Authority (PIA), the hosts of the A2ii Test Seminar on Financial Inclusion in September in Livingstone.

In response to the very low insurance penetration in Zambia, as well as new and innovative business models that do not fit squarely within the existing regulatory and supervisory frameworks, the PIA has embarked on a process to develop microinsurance regulations. The draft regulatory framework focuses primarily on product features, including bundled products, the distribution space (encouraging non-tradition channels), consumer education and protection, as well as training and accreditation.

The microinsurance regulatory process is rooted in the PIA’s long-standing involvement in the multi-stakeholder microinsurance development process that followed on from the 2009 Zambia access to insurance diagnostic.

Furthermore, the PIA is working with other financial regulators in implementing a national Financial Education Strategy and, in collaboration with industry, held the first insurance week in Zambia under the banner „Insurance for All“ in October 2013.