A2ii Newsletter 02/21

Welcome! In this newsletter, we provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Subscribe to our mailing list to receive our newsletter in your inbox.

The A2ii taking precautionary measures related to Covid-19

To safeguard the well-being of the A2ii staff and its partners, the A2ii is cancelling or postponing all physical events through the spring of 2021 and exploring the use of virtual formats when possible. Events that are scheduled to take place from May 2021 onwards are currently under review. The A2ii will communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Covid-19 Insurance Supervisory Response Tracker

We have a special page on our website dedicated to tracking worldwide supervisory responses, insurance news and learning resources (such as webinars).

Feel free to share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter.

New on the A2ii Website

The A2ii interactive Inclusive Insurance Regulation map

The A2ii interactive Inclusive Insurance Regulation map is a searchable collection of inclusive insurance regulations from around the world.

The map incorporates data sourced through A2ii's research, work and interaction with supervisory authorities worldwide. As such, it is by no means exhaustive and the information within is continuously updated to the best of A2ii's knowledge. To find out about legislation around the world, simply click on a country or explore the table.

In 2009, when the A2ii first compiled a map on inclusive insurance regulation, there were only six jurisdictions on the map. Since then, the A2ii and the IAIS have drawn on the experience of these pioneering countries to promote the implementation of proportionate regulations. As the numbers grew, we began to see that our collection of data could serve as a public tool for learning, research and peer exchange.

We welcome regulators to submit new information about the state of inclusive insurance in their jurisdiction by emailing secretariat@a2ii.org.

New interactive tool on A2ii website: Supervisory KPIs Lexicon

The newly-launched Supervisory KPIs Lexicon is an interactive, searchable directory of KPIs for insurance supervisors covering four areas, or ‘pillars’ of supervisory priorities: prudential soundness, market conduct, insurance market development and the link between insurance and the Sustainable Development Goals. KPIs under each pillar are drawn from established global best practices, supervisory experience, as well as ongoing research.

We invite insurance supervisors to use this as a reference on KPIs for measuring insurance sector performance and the state of the insurance market in line with their respective supervisory mandates. As this is an ongoing project, we also encourage supervisors and experts to submit your technical input, experience applying the KPIs or any questions via the form at the bottom of this page.

About the KPI Reporting Project

The KPI Lexicon is one part of a project by the A2ii, FSD Africa, Cenfri together with a Steering Group comprising insurance supervisors from Ghana, Kenya, Malawi, Mauritius, Uganda and CIMA countries, chaired by South Africa. The project was initiated to support SSA insurance supervisors with obtaining the necessary information to conduct effective supervision and evaluate the insurance market, in line with ICP 9 while recognising that supervisory mandates are evolving. The project comprises three main outputs. The Background Paper on the project can be found here. The implementation guidance, which will provide practical notes on using and analysing the KPIs drawing on SSA experience, is under development and due to be completed at end-2021.

Recent events

IAA Seminar Mini-Series: Risk-Based Financial Management with a focus on Asia - Pacific | 12, 19 and 26 January

The International Actuarial Association partnered with A2ii and the IAIS to organise a series of short webinars focused on Risk-based Financial Management and Supervision. The first series of three sessions was held in January, focusing on Asia-Pacific time zones with about 70-100 participants in each webinar. Recordings of the webinars can be seen here.

In the first session on 12 January, Fred Rowley and Alex Kuhnast discussed the ORSA as a core tool of risk-based supervision, providing some guidance for supervisors on what to look for when assessing an ORSA and what a strong ORSA process looks like. The second session on 19 January focused on de-mystifying the supervisory task of using actuarial reports, with Britta Hay and Stuart Wason sharing their experiences in supervision and the industry, including examples for life and non-life. In the latest session on 26 January, Nigel Bowman and Jules Gribble presented a tool developed by the IAA’s Inclusive Insurance Working Group, the IAA Risk Tool, which provides supervisors with a framework to assess risks and aggregate their cumulative portfolio impact. During the session, Edith Apoo and Ivan Kalimeri from the Insurance Regulatory Authority of Uganda (IRA) also shared their experience of working with the tool at the IRA.

The second series will take place on 4, 11, and 18 February (see more below) and will focus on time zones covering the Americas and Africa, with simultaneous translation to French and Spanish. Please register here.

Supervisory Dialogue Accounting Standards & IFRS 17: The Role of Insurance Supervisors | 28 January

The A2ii-IAIS Dialogues kicked off 2021 with a webinar on the new accounting standard IFRS 17. Over 300 supervisors took part with maximum capacity reached on both calls.

With only two years to go until the implementation deadline, transitioning to the new accounting regime has become a pressing issue for both the insurance sector and insurance supervisors. During this webinar, Peter Windsor and Jeffery Young presented their joint paper on insurer solvency assessment in the context of the implementation of IFRS 17. The paper is based on the results of a survey of 20 insurance supervisors.

Their presentation focused on the risks and challenges identified by supervisors but ultimately concluded that IFRS 17 was necessary in the long term to improve financial stability, transparency and comparability of the insurance sector.

This was echoed by supervisors who presented during the second part of the webinar. Supervisors from Bank Negara Malaysia, the Central Bank of Jordan, Cayman Islands Monetary Authority and Zimbabwe’s Insurance and Pensions Commission outlined the approaches their authorities had taken regarding IFRS 17.

A common theme with many of the supervisors was establishing a regional working group to provide peer exchange, support and ultimately avoid domestic interpretation of the accounting standard. Overall while all participants acknowledged the complexities and resource challenges involved, there was a general agreement that the long-term benefits outweighed the initial challenges.

A report from the event will shortly be published on our Blog pages. Subscribe here and stay up to date!

Upcoming events

IAA Seminar Mini-Series: Risk-Based Financial Management and Supervisions | 11 and 18 February

The International Actuarial Association (IAA), in collaboration with the Access to Insurance Initiative (A2ii) and the International Association of Insurance Supervisors (IAIS), has unveiled a mini-series of seminars focused on Risk-based Financial Management and Supervision. The three-part mini-series held in January focused on Asia-Pacific time zones. In February, the focus will be time zones covering the Americas and Africa and will also feature simultaneous translation to French and Spanish.

11 February - Using Actuarial Reports – Getting the Added Value

18 February - Proportionate Risk Assessment – The IAA Risk Tool in Action

Find out more on our website.

Index Insurance – A2ii-IAIS Public Dialogue addressing SDG 2 – Zero Hunger | 25 March, WebEx

The use of index insurance as an alternative to traditional indemnity-based insurance has increased over the last years, particularly as a mechanism for insuring extreme weather risks. Index insurance – also known as parametric insurance – has been evolving. Today, it reaches a wide range of customers, at the micro, meso and macro levels, ranging from the most vulnerable segments of the population to the most sophisticated and complexes sectors.

To take stock of recent developments, the A2ii conducted a survey with supervisors and other stakeholders on the current state of index insurance.

On 25 March 2021, the A2ii and IAIS will be sharing the outcomes of the research on athea public dialogue on index-based insurance. Highlights from the A2ii report on the topic and results from the index insurance survey will be presented. Participants will hear from industry experts as well as supervisory authorities who will share their experiences.

This webinar is also part of the A2ii’s 2021 theme of the year - the Sustainable Development Goals (SDGs). Insurance plays an important role in achieving multiple SDG goals and this dialogue will focus on how index insurance is a key component to achieving food security and ending hunger (SDG 2).

This 75-minute Dialogue will be open to all stakeholders and will take place at 10 am CET in English (with simultaneous French interpretation) and 4 pm CET in Spanish (with simultaneous English interpretation). Click here for more information or to register.

Scholarship opportunity

Access to Insurance Initiative (A2ii) together with InsuResilience Global Partnership are once again jointly sponsoring the participation of insurance supervisors in the Leadership and Diversity Program for Regulators, taught by Women's World Banking and faculty from Oxford University’s Saïd Business School. In 2021, the scholarship will cover six applications.

The participating regulator will nominate a team of a senior official and a high-potential woman official from the agency. During the program, the senior official identifies a policy initiative to sponsor at their institution related to serving the women’s market and will work with their high-potential woman leader to implement it, while simultaneously supporting her professional development during and after the program.

The program lasts 16 weeks and involves a series of interactive live online sessions, individual and group assignments, peer action learning and expert consultation opportunities. Each senior official identifies a policy initiative to advance women’s financial inclusion. The programme is in English and begins in April 2021.

Click here for application information.

Blog

The pandemic proposition – a stronger insurance front for sustainable development

By Dunja Latinovic

Imagine if every year the population of an entire country the size of the Philippines fell into poverty because of out-of-pocket expenditures on health services. The WHO data on global health coverage presents a sombre picture. Every year 100 million people are pushed into poverty because of lack of health coverage; that without the burden of a global pandemic.

Sixteen years of inclusive insurance regulation

by Rachelle Jung

By sheer numbers alone, it is clear there has been notable progress compared to the early days of microinsurance market development. Perhaps more interestingly, what has our research for the map told us about the ways in which inclusive insurance regulation has changed? Here we examine the pathways to inclusive insurance over the last sixteen years and the trends that have occurred along the way, including:

• Index Insurance

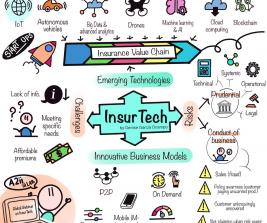

• Tech-driven models

• A renewed interest in dedicated licensing

• Challenges and learning opportunities

Continue reading…

Publications

El informe anual de 2019 ya está disponible en español

Haga clic aquí para descargar los informes anuales.

Our annual report 2019 is now available in Spanish

Click here to download the annual reports in Spanish.

Staffing Update

We are pleased to welcome Rachelle Jung to the A2ii team as a Junior Advisor.

In her role at the A2ii, she will form part of the communications team, will have a thematic focus on inclusive insurance and regulation, and will provide support to on-going A2ii projects and events.

She first joined the A2ii team as an intern in November 2019. Originally from the US, she worked in South Korea and Spain before moving to Germany to study a master’s degree in Development Economics and International Studies.