Access to Insurance Initiative Newsletter 08/2015

Welcome to our newsletter, where we update insurance regulators and supervisors on the work of the Initiative and inform you about events and publications.

Visit us at www.a2ii.org

Recent Events

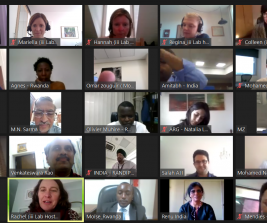

IAIS-A2ii Consultation Call on "Risk-based Supervision in Inclusive Insurance”

|23 July|

During the 11th IAIS-A2ii Consultation Call supervisors from across the globe discussed challenges they face with regards to the implementation of risk-based supervision in inclusive insurance markets.

Four calls were held – two in English, one in French and one in Spanish on which more than 60 supervisors participated from more than 30 countries with all regions represented (Africa, Asia, Caribbean, Latin America, Europe, North America).

On the French call Cameroon shared its experiences in implementing a risk-based supervisory framework, while the recently established Agence de Régulation et de Contrôle des Assurances (ARCA) from Burundi presented participants on the call with the challenges they are facing in adopting a risk-based approach in their jurisdiction.

On the English calls the Albanian Financial Supervisory Authority informed the participants about their risk-focused methodology that was developed in 2010 and adopted in 2014 following a joint project with the World Bank. As one of the main challenges in following the new approach Albania highlighted the great need for a sound knowledge of the insurance business model and experienced staff at the regulatory authority. Kenya and the Philippines also joined in sharing their experiences in introducing a risk based approach.

On the Spanish call discussions emerged on the topic of how to apply a risk-based approach to companies that provide both traditional insurance products and microinsurance products considering that the business line approach is very common in Latin America.

Please follow the link to download the expert presentations in English, French and Spanish. A full report of the call will follow soon.

If you are not currently on our mailing list and would like to receive the invitation for the next call in September please send an email to: consultation.call[at]a2ii.org.

10th annual conference of the Asian Forum of Insurance Regulators (AFIR)

|27- 28 July 2015| Colombo, Sri Lanka

A2ii participated on a panel on “developing a proportionate framework for inclusive insurance,” moderated by the IAIS alongside representatives from the Asian Development Bank (ADB), the Philippine Insurance Commission and the Insurance Board of Sri Lanka.

International Conference on "The importance of regulation in the development of microinsurance”

|30-31 July| La Paz, Bolivia

A2ii presented on a panel about cross- country learnings on regulatory responses to microinsurance market innovation. The event was organised by PROFIN and the Authority for Supervision and Control of Insurance and Pensions from Bolivia (APS) and attended by the Ministry of Finance, as well as supervisors and industry representatives from the region.

Participants discussed the main conditioning factors required for the development of regulation to support inclusive insurance. Participants highlighted financial education, market analysis and joint work by the public and private sector as fundamental elements of a successful inclusive insurance regulatory framework that can promote innovation and protect consumers at the same time. In addition, the practical application of the Insurance Core Principles to inclusive insurance regulation was also discussed.

Recent publications

Report of the 10th IAIS-A2ii Consultation Call on “Actuarial Approaches to Inclusive Insurance”

The 10th Consultation Call took place on 21 May 2015 on the topic of “Actuarial Approaches to Inclusive Insurance”.

The 10th Consultation Call took place on 21 May 2015 on the topic of “Actuarial Approaches to Inclusive Insurance”.

Since actuarial capacity is a challenge in most inclusive insurance markets the IAIS in close collaboration with the International Actuarial Association (IAA) will be developing a paper on "approaches to actuarial services in inclusive insurance markets". To inform the drafting group of this paper a consultation call was organised to obtain a broad perspective of the issues its members are confronted with respect to actuarial services.

The report of the call summarises discussion that evolved around the following questions:

-

Can an “actuary light” approach be justified?

-

How do insurance companies retain actuarial resources?

-

What actuarial approaches minimise costs for inclusive insurance policies?

Click here to download the full report summarising discussions and key insights of the 10th Consultation Call.

Article on the ‘State of Regulation and Supervision Supporting Inclusive Insurance Markets’

The A2ii published an article in the new annual Microinsurance Network publication ‘The State of Microinsurance’. In the article the A2ii gives an overview of the current status of microinsurance regulation, highlights recent trends in inclusive insurance markets and provides an outlook on their regulatory implications and potential challenges.

Click here to download the full report.

Now available in English: Microinsurance Country Diagnostic Colombia "Towards an inclusive universal insurance sector".

This diagnostic presents the landscape of Colombia’s microinsurance sector, identifies present and potential barriers to developing microinsurance as well as factors and opportunities that may contribute to developing the Colombian microinsurance industry. In addition, the diagnostic provides recommendations to accomplish such objectives.

The diagnostic is part of a joint project between the Superintendencia Financiera de Colombia, Bancoldex - Banca de las Oportunidades, the IADB (Fomin) and A2ii.

Please click here to download the country diagnostic in English and Spanish.