Access to Insurance Initiative Newsletter 05/2018

Welcome to our monthly newsletter, where we update you on the work of the Initiative, inform you about events and publications, and share experiences and learning on inclusive insurance regulation and supervision across jurisdictions.

Follow us on Twitter @a2ii_org where we serve you news and updates on #inclusiveinsurance

WATCH LIVE and have your say!

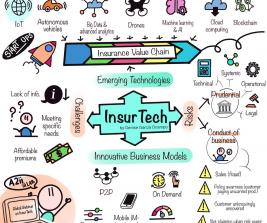

13th Consultative Forum on Mobile Insurance and InsurTech: rising to the regulatory challenge

9-10 May, Accra, Ghana

Take me to the stream!

The African Insurance Organisation, IAIS, the Microinsurance Network and the A2ii will hold its 13th Consultative Forum on “Mobile Insurance and InsurTech: rising to the regulatory challenge” on the afternoon of Wednesday, 9th May and morning of Thursday, 10th May 2017 in Accra, Ghana.

Watch the Forum LIVE in English or French, take part in the discussion either by submitting your answers to panellists’ questions through the menti.com or on Twitter #13thCF!

This Forum will focus on balancing innovation in the use of new technologies and how the various stakeholders – insurance supervisors, the industry and policymakers – can work to ensure that customers, many of whom have limited or no experience of insurance, are treated fairly.

The Consultative Forum takes place alongside the 45th AIO Conference and General Assembly.

Further information about the Forum is available here. For queries please contact A2ii Sub-Saharan Africa regional coordinator Janice Angove (janice.angove@fsb.co.za).

Recent Events

Inclusive Insurance Innovation Lab – second national workshops

10-12 April, Nairobi, Kenya

17-19 April, Accra, Ghana

17-19 April, Ulaanbaatar, Mongolia

24-26 April, Tirana, Albania

The second set of Inclusive Insurance Innovation Lab (iii-lab) national workshops began by reviewing the work that had been undertaken since the official start of the iii-lab last November. During this time, participants have created strong teams from across the insurance sector (including the regulator, insurance companies, intermediaries and demand-side stakeholders) that meet on a regular basis. All teams have undertaken learning journeys to help uncover the main obstacles to access to insurance in their countries and have agreed on areas they would like to focus on for the remainder of the lab process and thus where they believe they can come up with an ‘innovation’ which will make a positive difference to insurance market growth in their country.

In this respect, the second national workshops marked the transition from the analysis phase of the lab to taking concrete action. During the workshop, the teams were familiarised with the design thinking methodology and developed initial prototypes that will now undergo preliminary testing in the run-up to the Innovation Incubator in June, a four day workshop, during which all four country teams will meet in Albania.

To learn more about the project visit our website.

ASSAL Annual Conference

9-10 April, Santo Domingo, Dominican Republic

The ASSAL Annual Conference focused on "Risk Analysis and Assessment in the Insurance Sector". Regina Simoes, the A2ii Regional Coordinator for Latin America delivered a presentation on inclusive insurance with the participation of Peruvian and Colombian supervisors, who described different approaches to inclusive insurance in their countries.

The ASSAL Annual Conference focused on "Risk Analysis and Assessment in the Insurance Sector". Regina Simoes, the A2ii Regional Coordinator for Latin America delivered a presentation on inclusive insurance with the participation of Peruvian and Colombian supervisors, who described different approaches to inclusive insurance in their countries.

The President of the Dominican Republic, Danilo Medina, opened the ASSAL Annual Conference whereas the Minister of Finance, Donald Guerrero, gave the keynote speech.

The A2ii presentation will be available shortly on our website.

IAIS-FSI High Level Meeting

12 April, Santo Domingo, Dominican Republic

The Meeting focused on the global insurance standards and supervisory priorities in Americas. It was divided into 4 sessions: 1) Insurance Regulatory Reforms; 2) Emerging Risks and New Developments in the Market; 3) Proportionality; and 4) Cyber Risk management and insurance. IAIS Secretary-General Jonathan Dixon opened the event and moderated session 1 on insurance regulatory reforms. In his introduction, he highlighted the importance of the IAIS partnership with A2ii.

Regina Simoes, the A2ii Regional Coordinator for Latin America presented on proportionality in the context of financial inclusion, focusing on market conduct. The A2ii presentation will be available shortly on our website.

A2ii presents at AFI meeting on the inclusion of insurance in National Financial Inclusion Strategies

25 April

On April 25th the A2ii presented to Alliance for Financial Inclusion (AFI) members the results of a recent survey on the inclusion of insurance in National Financial Inclusion Strategies (NFIS).

The survey was a joint initiative between the A2ii and AFI and provides a stocktake on the extent to which insurance has been included in NFIS so far and also draws out lessons from its inclusion. The survey was sent to insurance supervisors via the A2ii as well as AFI members which mainly consist of Central Banks (some of which also have a mandate for insurance) and Ministries of Finance.

Among the 36 countries that responded to the survey 29 had included insurance in their NFIS and 18 of these even as a separate pillar. The survey, however, did highlight the need for insurance to be more fully integrated with clear definitions of ‘inclusive insurance’ developed at the outset to both focus efforts and establish benchmarks which could then, later on, be used to monitor the success of the initiative. It was also notable that most indicators focused on access and usage of insurance with few actually measuring the value of the product for the client. As NFIS, and in particular the inclusion of insurance, is still a relatively recent development it was not possible to obtain much information on the ultimate impact of the inclusion of insurance. However, a number of jurisdictions responding to the survey highlighted how it had already triggered helpful activities in their jurisdiction such as the development of microinsurance regulations, new products launches or/and greater flexibilities allowed for the use of non-traditional distribution channels.

The results of this survey will also be used to inform decisions on future potential joint activities of the A2ii-AFI on the topic of inclusion of insurance in National Financial Inclusion Strategies. A report detailing the results of the survey will also be published in due course on the A2iis website.

A2ii joins the InsuResilience Global Partnership

The A2ii recently joined the InsuResilience Global Partnership for Climate and Disaster Risk Finance and Insurance Solutions. InsuResilience was launched at the 2017 UN Climate Conference in Bonn and aims to strengthen the resilience of developing countries and protect the lives and livelihoods of poor and vulnerable people against the impacts of disasters. The A2ii is pleased to be a member of the Partnership and to contribute to this exciting and important global platform.

We believe that insurance plays an important role in protecting the most vulnerable and making communities more resilient when disaster strikes. As the implementing partner of the IAIS on financial inclusion, we provide input to global policy debates and draw attention to the valuable role of insurance and the key role of insurance supervisors in addressing resilience. Through capacity building, the facilitation of supervisory dialogue and peer-to-peer learning we strengthen the capacity and understanding of insurance supervisors to develop regulatory frameworks and supervisory approaches that are proportionate to risks posed by individual insurers. If well designed this should protect consumers and help build trust in insurance at the same time as incentivising insurance companies to provide suitable products to the poor and vulnerable thus helping increase their resilience to risk.

We are looking forward to being a member of a growing community on building financial protection to disasters and look forward to sharing learnings and experiences on the topic with other members of the Partnership.

Upcoming Events

Supervisory Dialogue on the impact of informality on insurance markets – what supervisors can do

17 May 2018, Rio de Janeiro, Brazil

The objective of this Supervisory Dialogue is to provide a platform for information sharing on the topic of informality of insurance markets. An overview of how informality may affect insurance markets will be provided with an examination of the risks for consumers as well as consideration on how informality may impact the structure and functioning of the sector.

The objective of this Supervisory Dialogue is to provide a platform for information sharing on the topic of informality of insurance markets. An overview of how informality may affect insurance markets will be provided with an examination of the risks for consumers as well as consideration on how informality may impact the structure and functioning of the sector.

The Dialogue will be restricted to supervisors and is expected to bring together high-ranking representatives from across the region and beyond.

There will be simultaneous translation into Portuguese, Spanish and English.

To find out more or to register, please click here.

IAIS-A2ii Consultation Call on Ratios and cost structures in insurance supervision

24 May – webinar

![]() When licensing and supervising insurance products, supervisors need to make judgements on the soundness, sustainability and ethics of the product proposed. This is particularly the case when products are designed as part of an initiative for increased financial inclusion, as those underserved segments often contain economically and socially vulnerable consumers with low familiarity with insurance products. This call will explore some of the approaches in evaluating this, the ratios involved (e.g. loss ratio, claims ratio, renewal ratio, and others) and some concrete examples of what considerations come into play. This call topic is a response to the discussions that took place in the IAIS Implementation Committee meetings in November 2017 and a request to the A2ii to explore the topic in more depth.

When licensing and supervising insurance products, supervisors need to make judgements on the soundness, sustainability and ethics of the product proposed. This is particularly the case when products are designed as part of an initiative for increased financial inclusion, as those underserved segments often contain economically and socially vulnerable consumers with low familiarity with insurance products. This call will explore some of the approaches in evaluating this, the ratios involved (e.g. loss ratio, claims ratio, renewal ratio, and others) and some concrete examples of what considerations come into play. This call topic is a response to the discussions that took place in the IAIS Implementation Committee meetings in November 2017 and a request to the A2ii to explore the topic in more depth.

You can register for this call here.

The IAIS-A2ii consultation calls are topic-focused webinars (via WebEx) for insurance supervisors.