A2ii Newsletter 07/20

Welcome! In this newsletter, we provide you with updates on the work of the Initiative, events and publications, and experiences and learning on inclusive insurance regulation and supervision across jurisdictions over the past month.

Follow us on Twitter @a2ii_org and LinkedIn and join the conversation on #inclusiveinsurance!

Contents

Covid-19 | Recent Events | Upcoming Events | Blog

The A2ii taking precautionary measures related to COVID-19 (coronavirus)

To safeguard the well-being of the A2ii staff and its partners, the A2ii is cancelling or postponing all physical events through the end of the year and exploring the use of virtual formats when possible. Events that are scheduled to take place from January 2021 onwards are currently under review. The A2ii will communicate any changes pertaining to our events on our website, social media channels and through our newsletter.

Covid-19 Insurance Supervisory Response Tracker

We have created a special page on our website dedicated to tracking worldwide supervisory responses, insurance news and learning resources (such as webinars).

Please feel free to share relevant news with us via secretariat@a2ii.org, by tagging Access to Insurance Initiative on LinkedIn or by mentioning us on Twitter. Visit the tracker.

A2ii-IAIS webinars

This year, due to the Covid-19 pandemic, the A2ii and the IAIS are additionally hosting exceptional webinars covering different aspects of Covid-19 and helping supervisors in their response. This includes the upcoming three-part series on pandemic risk (three webinars, two of which are open to all stakeholders).

Summaries of the webinars can be found on our blog.

For more information visit the webinars' page.

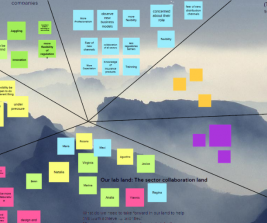

Inclusive Insurance Innovation Lab: First Global Call launches international lab process | 24 June

After three months of working in their respective country teams, the iii-lab participants from Argentina, India, Morocco and Rwanda finally had the chance to virtually meet each other in the long-anticipated first global call of the iii-lab 2020/21.

During an interactive and lively two hours, 41 lab members built the foundations of an international lab community, sharing their pressing questions with each other as well as the expertise that they have to offer. The lab’s hosting team was busy collecting and clustering all offers and will design the next sessions based on these insights.

Due to Covid-19 travel restrictions, the face to face international workshop that was originally scheduled to take place in June had to be moved entirely online. Instead, the international process will now take place in the form of monthly global calls until international travel between all countries is possible again. While moving the programme online cannot replace the experience of meeting face-to-face, the teams have shown that they are eager to meet and learn from each other also in the online world. The iii-lab hosting team is continuously learning about online processes and adapting its programme to meet participants’ needs. Follow the process on the new iii-lab page.

The Inclusive Insurance Innovation Lab (iii-lab) is an international capacity-building programme where 4 countries' teams work on innovative solutions to advance the development of their insurance market.

A2ii attends the GPFI Second Plenary, Saudi Arabian G20 Presidency | 24 – 25 June

Through virtual means, the A2ii participated in the Global Partnership for Financial Inclusion (GPFI) Plenary meeting on 25 and 26 June. Under the Chairmanship of the Saudi Arabian G20 presidency, the priority topics of Covid-19, digital, women, SMEs and youth were discussed. In addition, discussion was held on the GPFI’s Financial Inclusion Action Plan for the period 2021-2024 as well as its accompanying Terms of Reference.

All members agreed that Covid-19 should be added as a high priority to the GPFI’s work with members and international organisations, including the A2ii, using the opportunity to share their initiatives on the topic.

The A2ii also briefly took the opportunity to highlight the insurance protection gap exposed by the crisis and the need for insurance to be part of a more resilient solution for the future.

A paper containing High Level Policy Guidelines on digital financial inclusion of women, youth and SMEs was endorsed at the meeting for final approval by Finance Ministers at their meeting in July.

A2ii participates in Cenfri webinar on the 'Impact of COVID-19 on the sustainability of African insurance markets' | 25 June

In partnership with FSD Africa, Cenfri hosted a webinar on the impact of Covid-19 on the sustainability of African Insurance Markets.

The A2ii explored the impact of Covid-19 on insurance supervisor and the insurance sector jointly with panellists from FSD Africa and the Mauritius Insurance Association. While all three of the panellists came from different perspectives, there were some common underlying themes throughout the discussion. This included the fact that while insurers had had to respond to the pandemic on multiple fronts, the impact for some had been much more severe with certain insurers now facing an uncertain outlook.

The long-term challenges ahead included the need to preserve and attract new customers on a continent with low insurance penetration.

The webinar ended on a positive note by acknowledging that while there were immediate challenges to address, the crisis was also an opportunity for markets to strengthen, consolidate and for the insurance sector to re-evaluate their business models.

The A2ii was keen to highlight that this was an opportunity for the sector and for supervisors to embrace digitalisation and put consumers at the forefront of product design.

A2ii-IAIS Consultation Call webinar series on the coronavirus (Covid-19) pandemic and implications for insurance supervisors | 18 and 30 June, WebEx

In June, the A2ii has seen the continuation of its exceptional webinar series on Covid-19. On 18 June, we were fortunate enough to host supervisors from Hong Kong Insurance Authority, NIC-Ghana, EIOPA, ACAPS-Morocco and SUSEP-Brazil in a supervisory dialogue.

The dialogue on digitalisation explored the impact of Covid-19 on supervisory processes across various jurisdictions. In particular, it covered the challenges faced by supervisory authorities in the transition to remote working and supervision. Supervisors also outlined what they refer to as "temporary measures" that they have introduced to facilitate remote distribution to ensure that consumers still have access to insurance products. Examples included the increasing use of e-signatures and the development of regulatory guidelines on distance selling. The call concluded with the general consensus that the pandemic would lead to longer-term opportunities and incentives for supervisors and insurers to embrace digitalisation.

In the sixth webinar in this series, on 30 June, we partnered with Cenfri and AXA Emerging Customers who presented their research and work on remittances and remittance-linked insurance products. Cenfri presented their recently published report on the potential of remittance-linked insurance products in sub-Saharan Africa and highlighted the regulatory barriers and considerations that supervisors need to consider.

This was combined with AXA’s research and practical experience in countries such as Malaysia and the UAE with insurance linked remittances. AXA pointed to their recent partnership with the Western Union to offer remittance-linked insurance to their customers as an example of how supervisors can overcome regulatory barriers.

New A2ii-IAIS the pandemic risks webinar series | 13 July, 23 July, 30 July, WebEx

The next series of webinars on Covid-19 will focus on pandemic risks.

There will be three webinars over a three-week period. Participation for the initial webinars on 13 July and 23 July will also be open to all, while the 30 July call is limited to supervisors only.

The first webinar in this three-part series will explore public-sector initiatives including catastrophic risk insurance facilities and programmes to address the protection gap. It will also touch on the role of supervisors, the insurance industry and policymakers to work together to address it. In a moderated expert dialogue, we will hear from a range of experts including the Asian Development Bank, World Bank, Africa Risk Capacity and the United Nations Development Program.

Please look out for further details and registration information on our website.

If you have any suggestions or topics that you would like the A2ii to specifically cover for this webinar series, then please don’t hesitate to get in touch via consultation.call@a2ii.org.

To flatten the curve of Covid-19 and save lives, countries have widely accepted social distancing, setting off the slowdown of economic activity worldwide. Where remote work is not an option, reduced contact measures mean reduced earnings. For populations of low-and-middle-income countries, the cost of social distancing is proving higher than for those in developed countries. Continue reading...

The impact of Covid-19 in the Costa Rican insurance sector - an interview with Tomás Soley of SUGESE by Regina Simões, A2ii

Different jurisdictions and sector regulators have created special measures to deal with this crisis, reduce systemic risk and ensure market liquidity. This period will pass and we must ensure that these temporary measures do not affect the sustainability of the financial and insurance system in the medium and long term. Continue reading...

You can read this Spanish blog post in your own language with our built-in translator.

Subscribe to our blog mailing list

Publications

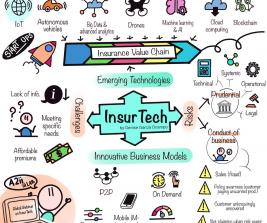

The Spanish and French versions of the report on the 2018 Consultative Forums on InsurTech – Rising to the Regulatory Challenge are now available.

This report is a summary of discussions and key messages from three Consultative Forums on InsurTech which took place in Africa, Asia and Latin America, organised by the International Association of Insurance Supervisors (IAIS), the Access to Insurance Initiative (A2ii) and Microinsurance Network (MiN). The forums provided a platform for in-depth discussions about the future of insurance and regulation given the rise of new digital technologies.

Over two hundred high-ranking representatives from insurance companies, digital providers, policymakers and regulators from 49 countries shared their views on how different stakeholders can work together to facilitate innovation, consumer protection and market development.

A2ii publishes the Spanish translation of the 'Insurance for Women: Specific Needs and Inclusion' event report

Following the English report, the A2ii has now released the Spanish translation of the report Insurance for Women: Specific Needs and Inclusion. The Roundtable on “Insurance for Women: Specific Needs and Inclusion” was jointly organised by the Superintendencia de Seguros de la Nación (SSN) and the Access to Insurance Initiative (A2ii), with the support of the International Association of Insurance Supervisors (IAIS), and it was held on 12 June 2019 in Buenos Aires, Argentina