International Women's Day: #ChooseToChallenge

As part of the A2ii’s vision that more poor and vulnerable people have access to and use affordable insurance appropriate for their needs, we are committed to advancing gender equality in insurance.

Follow our #a2iiwomen campaign on LinkedIn and Twitter.

International Women's Day 2021

On the occasion of International Women’s Day 2021, at the A2ii we wanted to put forward this brief overview of the state and importance of women’s access to insurance and the insurance supervisors’ role in increasing financial inclusion. Gender, and women’s access to insurance is among A2ii’s focus thematic areas. We support insurance supervisors in their work to remove barriers and advance the women’s insurance market through knowledge generation, capacity building and advocacy activities. Read about our key projects, events to watch out for and other important gender-focused resources on our website.

Women form a significant part of the underinsured segment of the population, especially in developing countries. Lack of data, socio-cultural barriers, and low financial literacy levels are often cited as some of the main factors behind this. The gender gap in digital inclusion further contributes to this divide, which is of particular relevance in the context of the Covid-19 pandemic, where digital means of doing business and communicating with customers has gained more importance.

Given the role that women play in managing household risks, it is of broader benefit to households if insurance products are designed that fit their needs.

Integrating a gender perspective in regulation and supervision is key to increasing financial inclusion. Insurance supervisors can play an important role in enhancing women’s access to inclusive insurance by incorporating gender perspectives in relevant areas of regulation and supervision.

A2ii work on women’s access to insurance

'Empowering supervisors to improve women's access to insurance', project supported by the Swiss Development Cooperation (SDC)

The project aims at providing insurance supervisors with the knowledge and tools needed to create framework conditions that facilitate better access to high-quality insurance for women.

A2ii will undertake a snapshot review of the current state of women’s access to insurance, the effects of Covid-19, and the role insurance supervisors are playing in enhancing women’s access to insurance.

The project will also focus on capacity building of insurance supervisors to better address the challenges women face in accessing insurance services, and advocate for a gendered approach to inclusive insurance. A key part of this effort will be to target women supervisors and strengthen and empower them to step into leadership positions. Importantly, the project will enable A2ii to mainstream a gender focus in all its activities by taking a gendered lens to our workplan and our trainings, events and publications.

Scholarships that advance women’s financial inclusion

With the InsuResilience Global Partnership, A2ii offers six scholarships for insurance supervisors, targeted at high potential women leaders, who pair with a senior official from their organisation, to attend the Leadership and Diversity Program for Regulators organised by Women’s World Banking and work on a policy initiative for their women’s market.

For this year’s scholarships, there is still time to apply by 12 March. To learn about the impact of this programme, check out our interview with Alma Gomez, a programme alumna and the Supervisor of Insurance & Private Pensions from Belize, who spoke to us about her experience in the programme and women’s financial inclusion in Belize.

Coming up: A2ii-IAIS Public Dialogue on women’s access to insurance

On 27 May, the A2ii will hold its fourth Dialogue of 2021 on women’s access to insurance within the SDG 5 theme of Gender Equality. The Dialogue will be open to all stakeholders. Watch this space for more information coming soon.

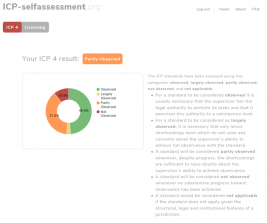

Measuring gender equality

Our website features an interactive, searchable directory of Key Performance Indicators across four pillars: Market Conduct, Market Development, Prudential and the SDGs. The SDGs pillar provides 14 indicators in relation to SDG 5: Gender Equality - metrics that can be used by supervisors and policymakers to get a better understanding and advocate for women’s access to insurance in their markets.

Briefing notes and reports

- Bridging the Gender Gap: The role of the Insurance Supervisor | EN FR ES

- Briefing note: The role of insurance regulation and supervision in promoting inclusive insurance for women | EN FR ES

- Report: Mainstreaming gender and targeting women in inclusive insurance: perspectives and emerging lessons | EN

- Event Report: Insurance for Women: Specific Needs and Inclusion | EN ES